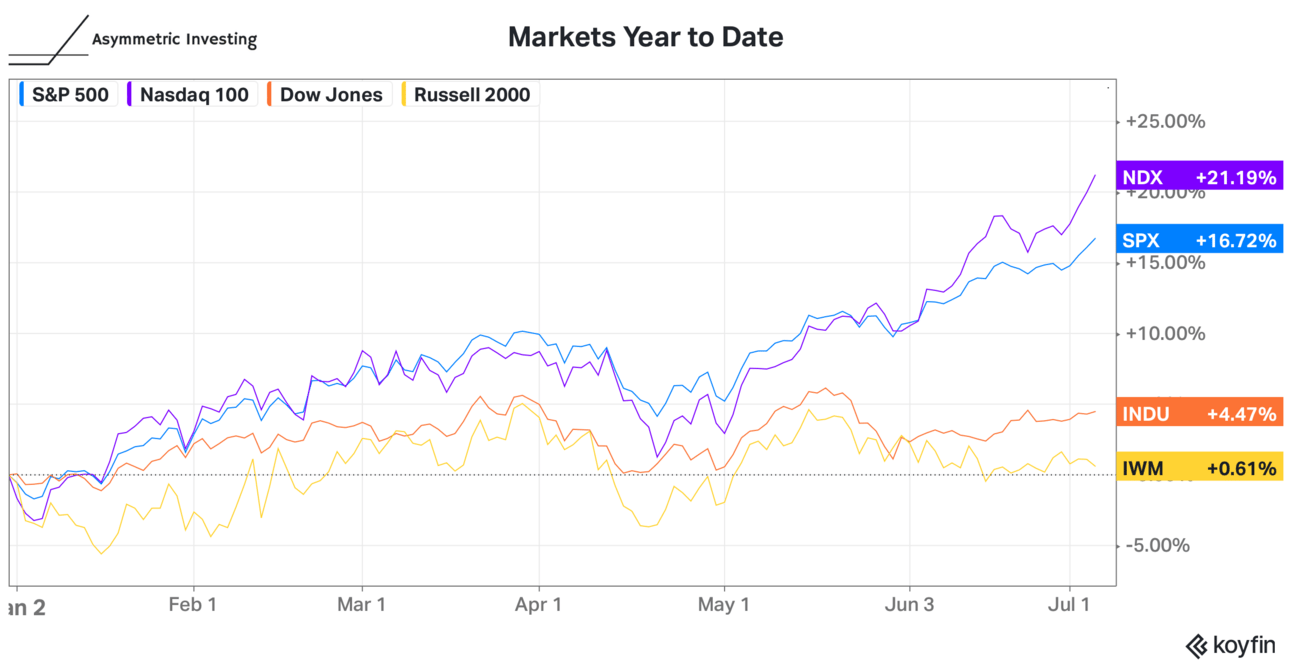

The stock market has had a great year in a lot of ways in 2024. You can see below, markets are up, although gains are heavily weighted to the Nasdaq 100 and the biggest of the big tech stocks.

Everything AI has zoomed higher. We don’t yet know if that’s speculation or something real, but I’ll get to that below.

The Asymmetric Portfolio continues to suffer from a lack of exposure to big tech. I think that will be a wise allocation of resources long-term as many big tech companies (Apple in particular) see stocks rise from multiple expansions and not earnings growth. And I’m not buying into the AI bubble I see forming, which may be right long-term but hasn’t been short-term. Earnings season will tell us a lot about both trends.

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

What I Bought in July 2024: The allocations to the Asymmetric Portfolio this month are out.

Disney’s Comeback: Disney is still the brunt of a lot of jokes in the media and online but the numbers show movies improving, linear networks holding their own, and streaming is growing faster than you might think.

GM is Growing Faster Than Tesla?: Q2 delivery data is out and Telsa’s deliveries dropped 5% while GM was up 1%. Here’s what I see going on.

Time to Sell Apple: Apple stock continues to rise but the business is no longer growing.

What to Watch in Earnings Season

There’s a tension in the market today. Stocks are trading at all-time highs, but data indicates the economy is slowing.

Retail: Consumers drive the economy and if you only looked at retail sales you may think we’re already in a recession. Target (down 3.7%), Home Depot (down 2.8%), and Best Buy (down 6.1%) are just a few of the retailers reporting a decline in same-store sales while discount firms like Walmart are seeing sales rise (up 3.8%). Is the consumer weakening because of inflation and a weak jobs market or is this a post-pandemic return to normal?

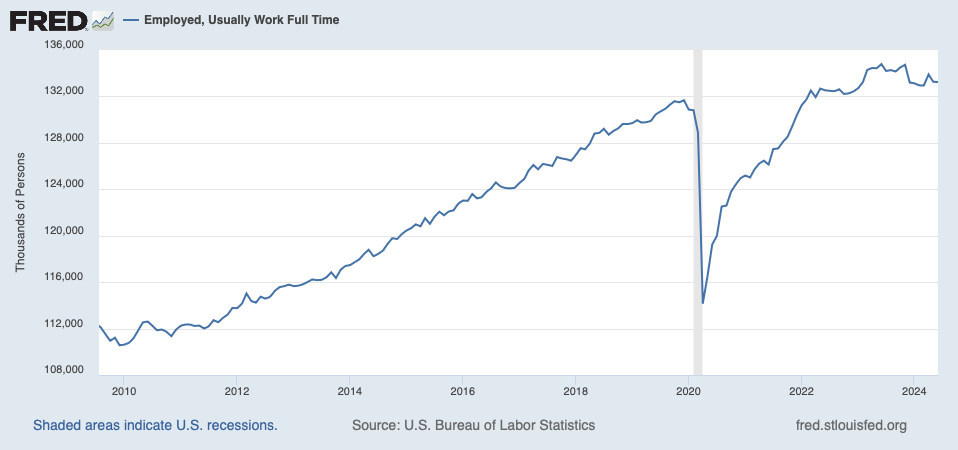

Jobs: I’ve included a couple of charts below that I’ve been watching. The story emerging is full-time jobs stalling out in the U.S. while part-time jobs continue to rise. Jobs data is messy month to month but these charts show the trend back to the Great Recession and the trends look clear to me. I’ll be looking to hear more from companies (automakers and banks in particular) about the impact on demand and lending.

Inflation/COGS: Inflation is high, but the data is messy. I’ll be looking at inflation’s impact on consumer and business spending patterns as well as margins (costs of goods sold). There will be some places where falling costs will be a tailwind and others where they’re a headwind.

Artificial Intelligence: The AI run gained steam in Q1 2024 when Google, Meta, Microsoft, and many more announced tens of billions of dollars of investment in artificial intelligence investments. I’ll be looking for signs there’s actual AI-driven revenue (which seems important) and that investment will continue. Any sign of weakness will be crushed by the market.

This week will be dominated by big banks and big tech will start the following week, but we should get an idea of earnings trends in the next few weeks.

I’ll be covering specific earnings previews starting later this week.

As I mentioned yesterday, short and sweet update today. Have a great week!

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.