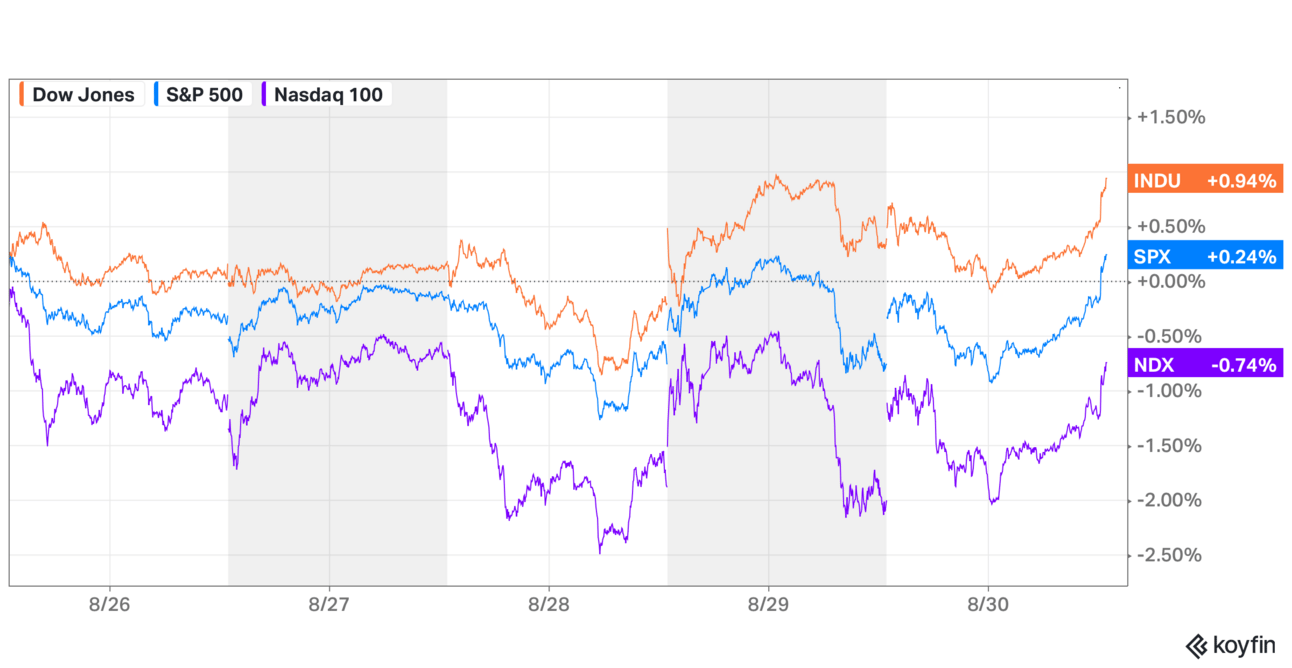

The stock market had a sideways week despite one of the biggest earnings reports of the year. NVIDIA reported another great quarter but didn’t give much of an indication of whether or not AI spending is accelerating faster than expected or slowing faster than expected. For once, analysts seem to have their hands around how fast the company is going to grow and that has brought some comfort to the market.

The Asymmetric Portfolio was relatively quiet without much in the way of earnings to react to. With another month left in the third quarter, I expect most of the market’s moves to be dictated by the Fed, for better or worse.

Asymmetric Investing is a freemium business model, which means the free version is made possible by ads like this one. Sign up for premium here to get 2x the content, access the Asymmetric Portfolio, and avoid ads.

Steal our best value stock ideas.

PayPal, Disney, and Nike all dropped 50-80% recently from all-time highs.

Are they undervalued? Can they turn around? What’s next? You don’t have time to track every stock, but should you be forced to miss all the best opportunities?

That’s why we scour hundreds of value stock ideas for you. Whenever we find something interesting, we send it straight to your inbox.

Subscribe free to Value Investor Daily with one click so you never miss out on our research again.

In Case You Missed It

Here’s the content I put out this week. Back to a regular publishing schedule next week.

Why It’s Dangerous to Learn From Tesla: One line I see far too often is investors saying a stock is “the next Tesla”. There may never be another Tesla for a lot of reasons and even Tesla may not be who you think it is.

Peloton’s Comeback?: Don’t look now, but Peloton is setting up for a comeback.

An Innovation Machine: Have you seen On’s new spray-on shoe? It could be the future of shoe manufacturing.

Compounding Is the Key to Investing

If there's one concept all investors need to understand it’s compounding. Over time, generating a reasonable rate of return year after year is the best way to not only build wealth but also beat the market.

Two of the Asymmetric Frameworks are leaning into the time advantage we have over institutional investors and living further out on the risk curve. These advantages only work because of compounding.

The Numbers Behind Compounding

If you let $100 compound for a decade in a savings account that doesn’t pay interest…you’ll have $100.

That’s not a way to build wealth. But higher rates of return can build on themselves faster than you think.

Get a 1% interest rate and you’ll have just $1 extra after a year, but you’ll end up with $109.37 after 10 years.

Up the return to 10% and you wind up with $235.79 after a decade.

A 20% return gives you just $20 in profit after a year but after 10 years you would have $515.98.

Compounding is powerful…if you let it work.

It’s no surprise we should want higher returns, but how do we get there?

Volatility Is the Price You Pay For Higher Returns

My friend Morgan Housel put it this way:

No one can generate market-beating returns with no volatility. And the Asymmetric Portfolio is no exception. Below you can see the returns of each stock since the spotlight article was published.

There are some losers on this list. But the most you can ever lose in an investment is 100% of your money invested. Look on the right of the chart. Two stocks have already generated over a 100% return and can compound further from here.

This volatility in returns is a feature, not a bug in the Asymmetric Investing process. It also takes time to work.

The reason we want to invest in an array of high-potential stocks is because we don’t know which stock will be the one that returns 20%, 30%, or more over the next decade.

But if we have just one winner in the portfolio, it can make up for all of the losers.

The table below shows how short-term volatility can result in downright terrible returns. This is the return of five $100 investments at various rates of return after a year. Two go to zero, one stays flat, and the other two compounds at 10% and 20%.

Annualized Return | Principal | Value in Year 1 |

|---|---|---|

-100% | $100 | $0 |

-100% | $100 | $0 |

0% | $100 | $100 |

10% | $100 | $110 |

20% | $100 | $120 |

Total | $500 | $330 |

Give the portfolio time and a different story emerges. This isn’t a losing portfolio, it’s a massive winner over a decade.

Annualized Return | Principal | Value in Year 10 |

|---|---|---|

-100% | $100 | $0 |

-100% | $100 | $0 |

0% | $100 | $100 |

10% | $100 | $235.79 |

20% | $100 | $515.98 |

Total | $500 | $851.77 |

This table shows an annualized return of 10.5%, which would beat the market’s returns over the long term. And that’s with only 40% of the portfolio making money.

And the money made is the result of just two stocks compounding at a relatively modest 10% and 20%.

What happens if a stock or two compounds at 30%? Or 40%?

You get asymmetric returns. And that’s the point.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.