A reminder that I will be attending Virgin Galactic’s next launch on Friday, January 26, 2024. I’ll be covering what I learn about the business, Delta developments, discussions with management, and the spaceport for premium subscribers. If you have any questions about Virgin Galactic, please respond to this email or in the comments section.

I will be hosting a live AMA after the flight with Steve Symington of Bottom Line Investing on Friday. You’ll get details later this week.

I hope you had a wonderful week!

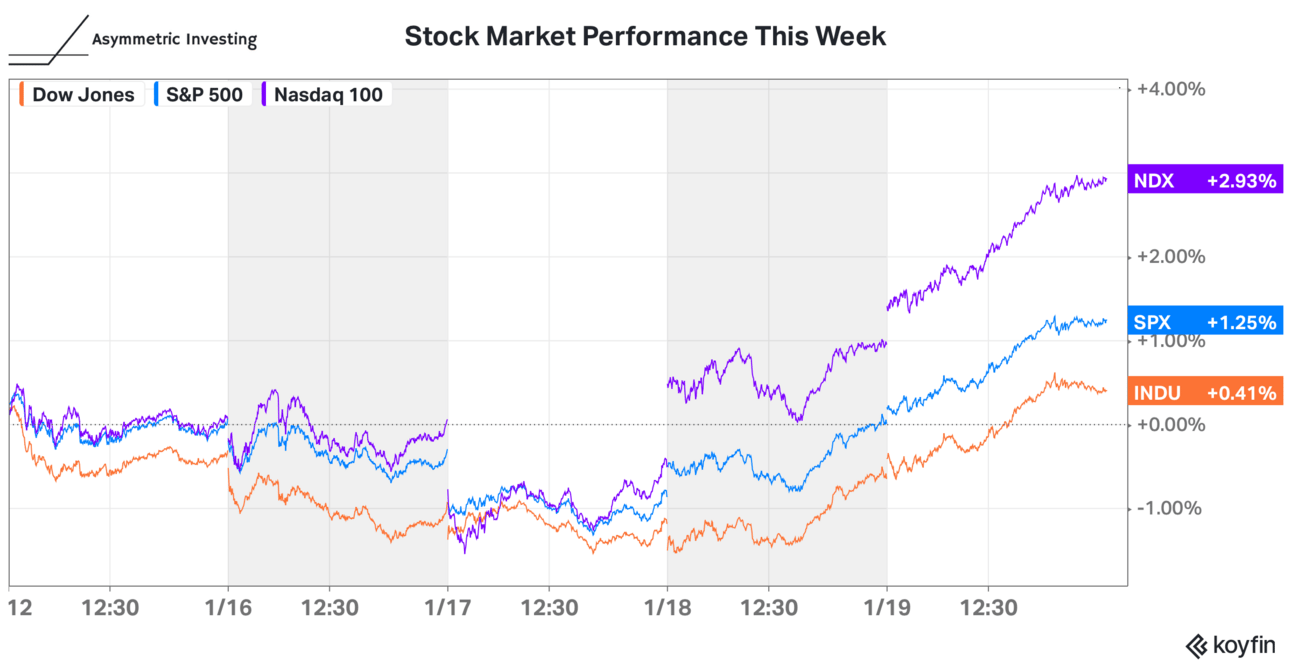

Earnings season began for a handful of companies last week and you can see the market reacted positively. Over the next few weeks, we will get more reports and I’ll cover Asymmetric Universe stocks throughout earnings season.

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

Google’s AI Inevitability: The market is crazy about artificial intelligence, but when you take a step back and look at where the industry is headed, how does Google not end up a winner?

The Case For Peloton: I make the case that Peloton has made all the right moves strategically in 2023 and now we’ll see if that pays off financially. (premium)

New Spotlight Article: This is the smallest market cap company I’ve covered at about $55 million and survival isn’t guaranteed. But if this company makes it through the next 12 months there’s a path to this being not just a 10x stock, but a 100x stock over the next decade. (premium)

Why Chewy Stock Is a Buy Now: If you have a pet, you know Chewy. The company has been a growth machine over the past 7 years and if management’s investments in fulfillment centers pay off it could be a winner for investors for the next decade.

Picking Up Pennies In Front of Steamrollers

One of the reasons I called this investment research newsletter Asymmetric Investing is because I want to put front and center exactly what kind of investor I am and what I’ll be researching. It’s in the name and reinforced by the logo that I’ll be covering stocks with huge potential that could also flop. If that matches your investment style, this content is a perfect match!

Other investors have different styles — and that’s great.

But when you try to crossover to another style, you’re entering risky territory.

This week, I saw many investors get burned by a U.S. judge denying the JetBlue-Spirit Airlines merger, which sent Spirit’s shares down as much as 73%. I won’t get into the deal’s demise, which my friend Lou covered on Fits and Starts this week, but I want to look at it from a risk perspective.

The trade seemed so easy. JetBlue agreed to pay $33.50 per share for Spirit Airlines, about double what the stock traded for a week ago. Why not just buy shares and profit from the “arbitrage” opportunity?

This is why.

Arbitrage is a risky game. Professionals who do merger arbitrage (often called “special situations”) for a living play with options, obscure hedges, billions of dollars…and inside information🫢. What’s your advantage over the market?

It’s picking up pennies in front of a steamroller.

Know your investment style. Lean into it. And tune out the noise.

I think a lot of investors learned that this week.

You can get all Asymmetric Investing content, including deep dives, stock trades before they’re made, and ongoing coverage of Asymmetric Universe stocks like Disney with a premium membership.

All for only $100 per year.

What do you want more of?

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.