This won’t be your regular Sunday post. Today, I will give more detail on what’s going on with the Asymmetric Portfolio, the one special situation position I started early this year, and my thoughts on investing in the current environment.

To give some overall perspective, my goal with this newsletter is to not only provide research but also to bring you along my investing journey as I show how I use investing frameworks that have proven to outperform the market over decades.

Those frameworks exist for a reason. They keep me from selling great stocks just because they bounce. They force me to be more aggressive when at times of dislocation (like now). And they’re a calming reminder of what works long-term.

Speaking of bringing you along on my investing journey, I’ve been asked to join Slice as a Mentor for investors. It’s a young company with a great mission and the right incentives for investors and mentors. Slice will augment what I publish here, giving a deeper look into the “why” behind Asymmetric Investing and providing insights into business strategy and what I’ve learned in 30 years of investing. I’m officially launching on Wednesday, but you can find the app below. Since I have joined Slice, I also closed the premium memberships on YouTube. More on Slice later in the week.

Why the Stock Market Is Plunging?

Let’s discuss the elephant in the room. On Wednesday, President Trump announced sweeping tariffs on nearly every country in the world at levels that could cause a deep recession if fully implemented in the U.S.

The tariffs weren’t a surprise, but the scale and haphazard nature was. Countries like Cambodia (49%) and Vietnam (46%) will see debilitating tariffs that will likely do little but make shirts and shoes more expensive for Americans.

In addition to the impact on consumers, the tariffs make business more unpredictable and if you’re planning a new factory or building a supply chain for new products, uncertainty is bad.

That’s why the market has dropped. Consumers drive the U.S. economy and if a bigger chunk of their paycheck is going to pay taxes tariffs it leaves less for eating out, home renovations, and other consumer spending. And businesses may already be starting to pull back because of tariffs.

There are potential positives if businesses begin manufacturing in the U.S., but that payoff is years away and may not ever come to fruition. But more on that later.

My Stocks Are Plunging Too, But My Hedge Is Working

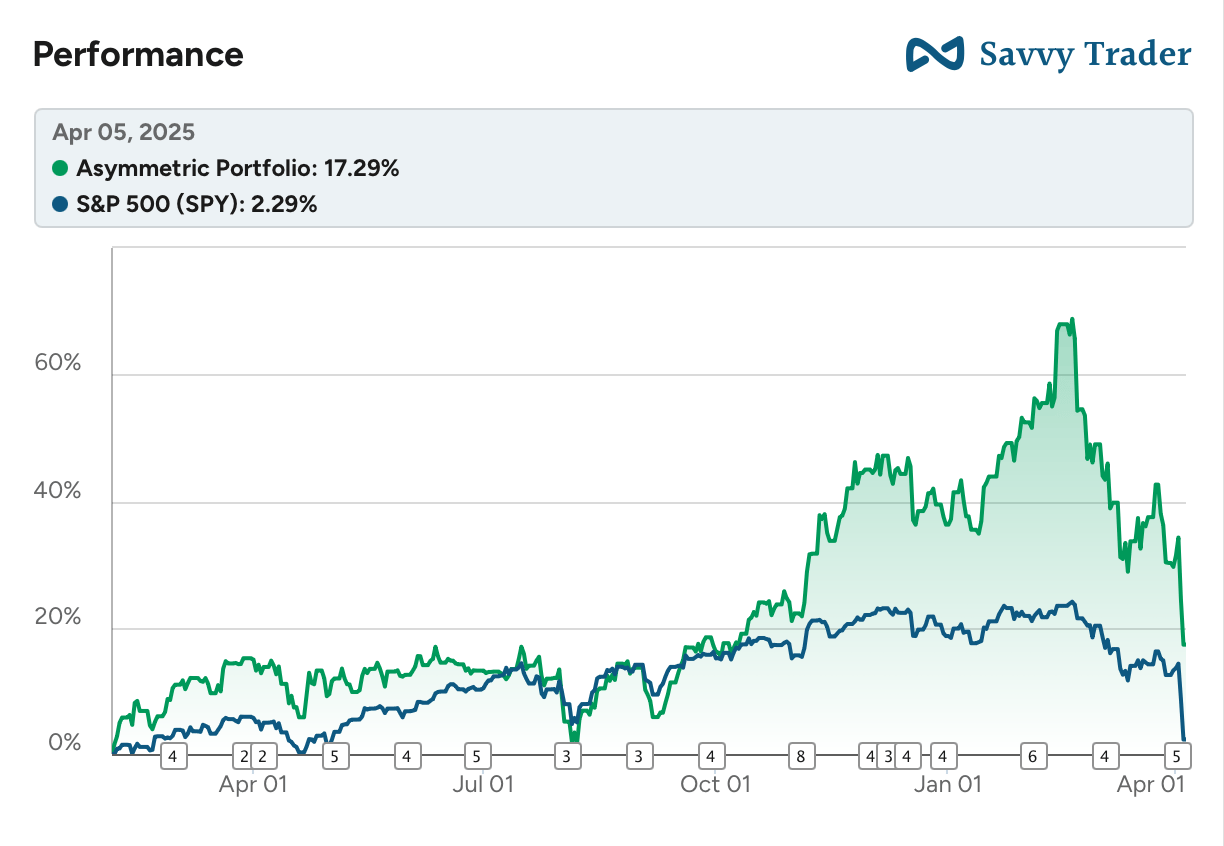

To say this week was bad for the Asymmetric Portfolio is an understatement. The Asymmetric Portfolio continues to plunge as the market sells anything associated with growth.

Wilder yet is the S&P 500 is now down 1.5% in the past year and the Nasdaq 100 is down 2.9%. Since the Asymmetric Portfolio began in May 2023 the market is still up but has lost over half of its peak gains.

I want to put this chart into perspective because I buy stocks once a month and EVERY SINGLE MONTH SINCE FEBRUARY 2024 THE MARKET WAS HIGHER THAN IT IS TODAY. More than half of the capital I’ve deployed was at higher market prices than today.

It’s hard to beat the market when you buy higher-risk stocks like I do and the market is going down. This dynamic will turn and will eventually become a tailwind, but we aren’t seeing that right now.

The only saving grace for the portfolio has been the short of Tesla I started on January 22, 2025. That position is up nearly 200%.

To bring it all together, below is a look at the capital invested and total portfolio value, including the special situation. The Tesla short, which was partially intended to be a hedge, has worked. But the decline in the market is certainly taking its toll.

Markets Crash, What You Do Next Matters Most

What should we be doing now that the market is crashing? There’s no easy answer, but we have some guides for what might be next.

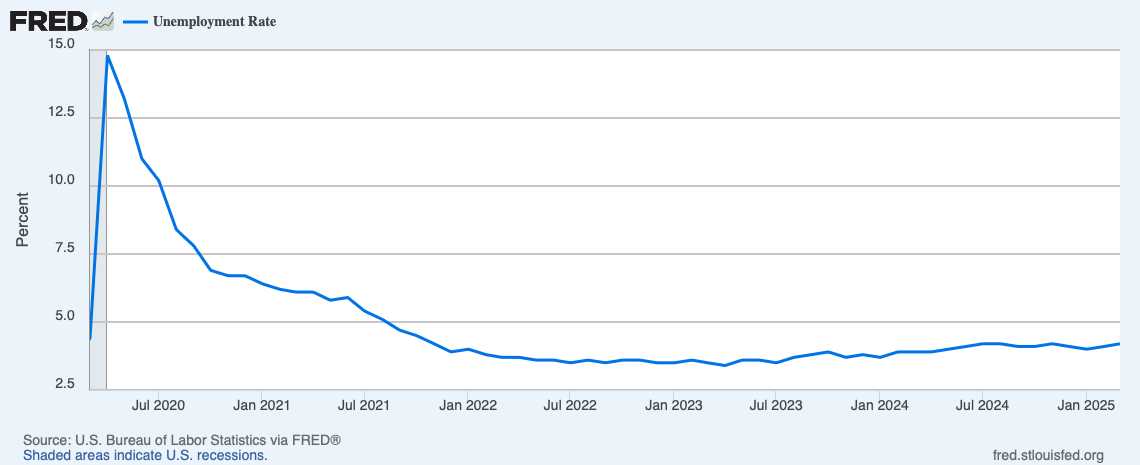

Let’s start with some historical context. In my investing life (starting in 1995), we have been through two “normal” recessions. I’m not counting COVID because it was anything but normal and the market surged to new highs in a matter of months.

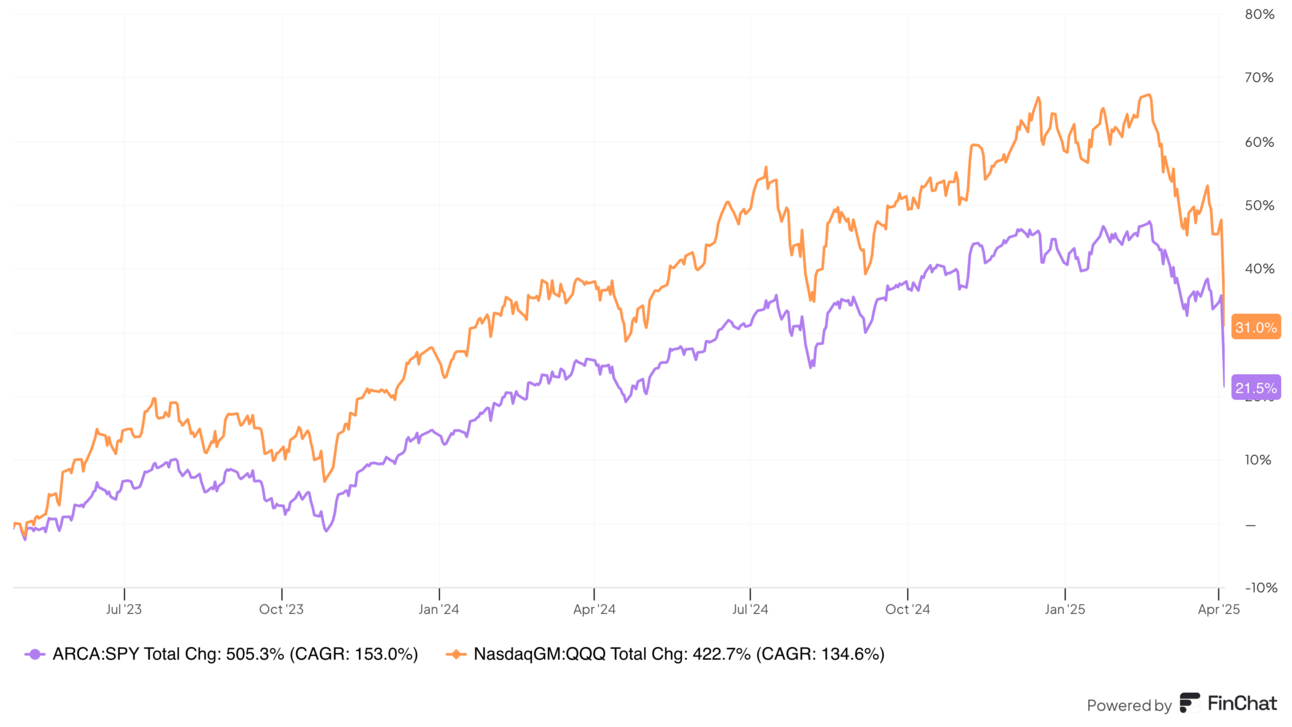

The longest downturn in the market was after the dot-com crash. The market peaked in early 2000 and the market wouldn’t see new highs for nearly a decade. The Nasdaq 100 took over 10 years to get back to 2000 highs.

I show this chart because I see a lot of “I bought the dip” reactions to every market drop this year. I like the sentiment, but if the tariffs indeed send the U.S. economy into a recession and there are structural changes to global trade, this dip can keep dipping for a LOOOONG TIME.

I prefer to be prepared to be a buyer over time, rather than trying to time the dips. I’ll continue to buy stocks every month and will buy more aggressively the further the market falls.

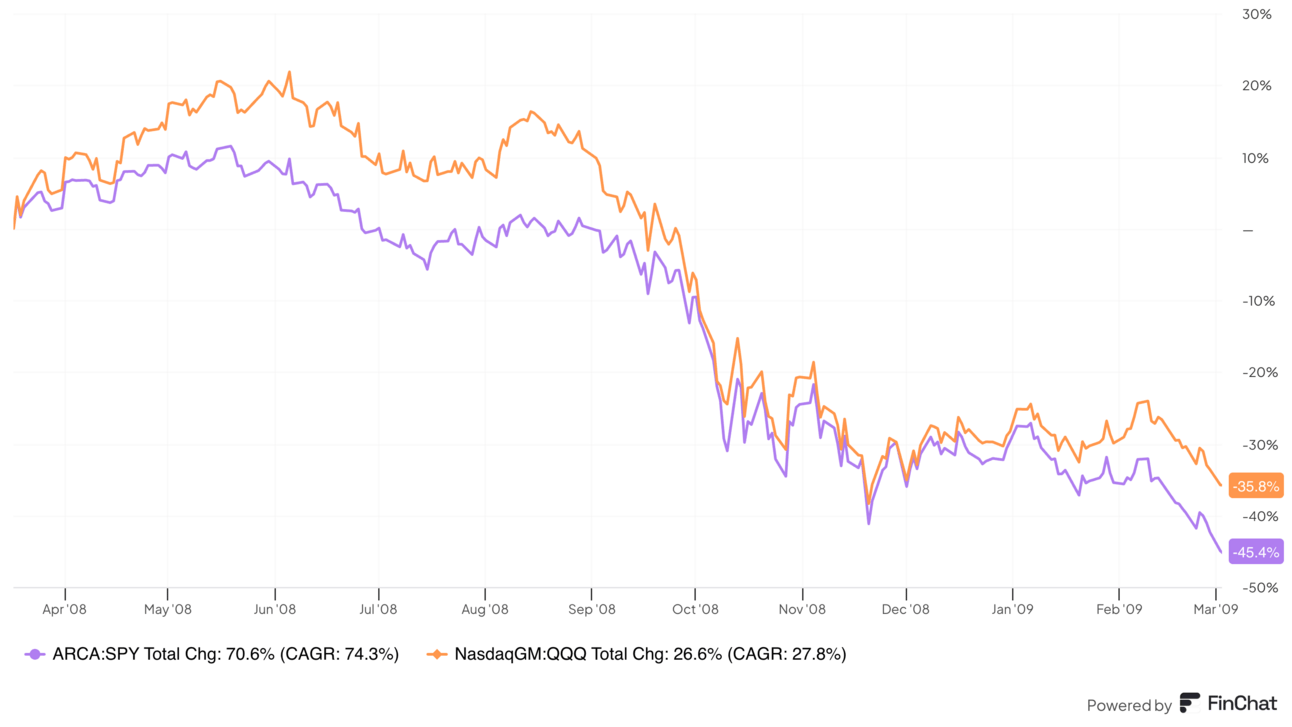

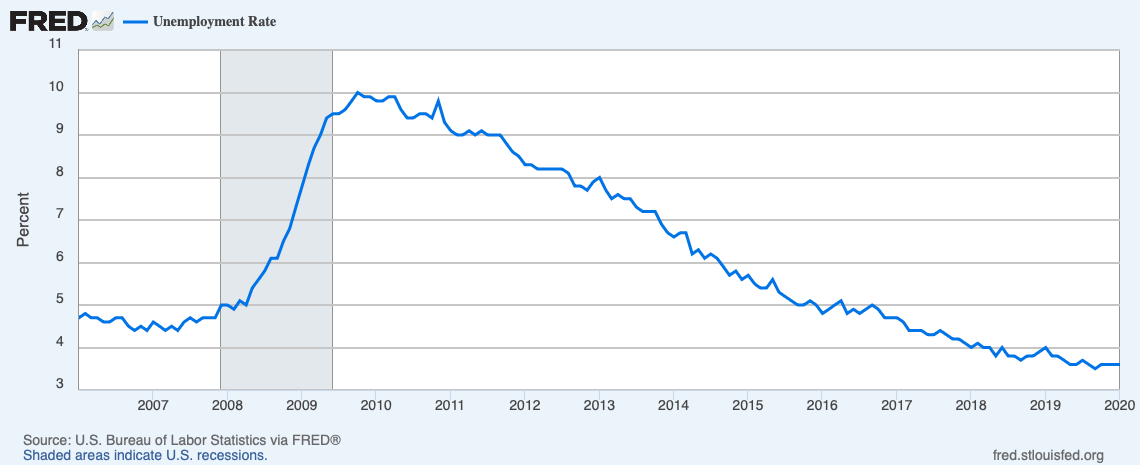

The other historical context was the Great Financial Crisis and it’s easy to forget how long it took to go from the panic starting to the market’s bottom. On March 16, 2008, Bear Stearns collapsed following the popping of a condo bubble that revealed a credit default swap bomb sitting on Wall Street balance sheets.

Buying the Bear Stearns dip and the dramatic government response would have seemed wise, but the pain was just beginning. Officially, a recession started in December 2007 and wouldn’t end until June 2009.

The market rallied from March 2008 to June 2008. But zoom out a bit and between the Bear Stearns collapse and the market bottom in March 2009, the S&P 500 would fall another 45%.

If you weren’t employed or investing in 2008, it’s hard to explain just how bad the economy got. I was laid off as part of a massive round of job cuts at 3M…once seen as one of the safest jobs in the country.

You can see that when Bear Stearns collapsed the unemployment rate was only about 5%, higher than it is today.

Unemployment wouldn’t peak until October 2009, 19 months after Bear Stearns.

Should we be buying the dip?

Yes.

But the dip can keep dipping for a VERY LONG TIME!

It’s very possible we won’t see the highs of early 2025 for years.

Why This Market Crash is Different

The two market crashes and recessions I highlighted above were “normal” because there was a market top, something happened to pop a bubble, larger unforeseen risks were revealed, and the economy was dragged into a recession.

This time is different.

We haven’t seen a bubble burst (yet).

Unemployment isn’t picking up (yet).

But the tariffs announced last week by President Trump could single-handedly send the U.S. economy into a tailspin.

Prices could go up on nearly everything, leading to inflation.

Inflation puts further pressure on already stretched consumers.

Business profits suffer and they cut back on hiring and investment.

Layoffs begin.

Consumers get more fearful and cut back even more.

Profits fall more, which leads to more layoffs.

The downward spiral could already be underway. But this time it isn’t a bubble pushing us into the spiral, it’s tariffs doing it.

This is self-inflicted economic harm.

And it seems the administration knows that. The economic pain that’s coming is a feature, not a bug.

This is what the market is realizing right now.

These tariffs aren’t just a negotiating ploy. They’re an effort to reorient the global economy to make the U.S. more self-sufficient in low-end manufacturing.

However you feel about how poorly planned these tariffs are or how nonsensical it is to levy tariffs on an island of penguins, the goal here is fundamentally reshaping the U.S. economy.

For better or worse.

That’s the lens with which to look at everything this week.

On top of the tariff impact on the economy, Elon Musk and President Trump are cutting federal spending. For the first time in history, we could see the federal government’s budget cuts help cause a recession, rather than being a ballast against a recession.

There is no lifeline.

Congress isn’t coming with a trillion-dollar bailout to buy bad debt like it did in 2008.

There’s no COVID-style bailout for small businesses like we saw in 2020.

If prices rise and business profits drop, layoffs will begin.

If layoffs begin as consumers and the government cut back, who knows where the bottom is?

But there’s a silver lining.

President Trump Isn’t King and Tariffs Can Be Temporary

We are also talking about a policy decision made in the United States of America. And President Trump isn’t the only one who has a say about tariffs or reshaping the global economy.

All of the tariffs announced last week could be reversed with the stroke of a pen.

Some may have changed by the time you read this.

Tariffs could be cut if President Trump negotiates deals with trade partners, which seems less likely than it did only a week ago for the reasons noted above.

If conditions get bad enough, Congress could take action. It’s Congress that gives the president the ability to create tariffs in the first place. And Congress can take that power away. Rumor is, that the fight against tariffs has already begun in Congress.

Voters also have a say. There are only 575 days until the midterm election and President Trump will only be president another 3 years and 9 months.

Self-inflicted harm from tariffs can be reversed.

Damage to reputations and relationships may endure, but a pullback doesn’t have to become a recession, which doesn’t have to become a depression.

Everyone in the system has agency.

I write all of this to point out that we shouldn’t be investing scared because of a policy we may or may not disagree with. If this policy is a disaster for the economy and the market, it will be changed one way or another.

Buying in the intervening months or years may be the biggest opportunity we have in the next decade if the market gives us great prices for great companies.

Multiple Things Could Be True

At times like this, it’s important to hold multiple thoughts/possibilities in your head at the same time.

This can be a buying opportunity for stocks

Stocks can still go much lower

Tariffs may cause a recession in 2025

The U.S. economy will absorb tariffs reasonably well

Tariffs will cause higher employment and wages long-term

Tariffs will cause geopolitical tension and may even lead to war

Tariffs will cause economic cooperation between former enemies (China, Japan, and South Korea)

Some of these statements are true.

And none of them are mutually exclusive.

The Big Questions: How Do Businesses React? & What Breaks?

I’m extremely interested to see how businesses respond to this news. The narrative from business leaders and investors only a few months ago was that this would be a new golden age for business.

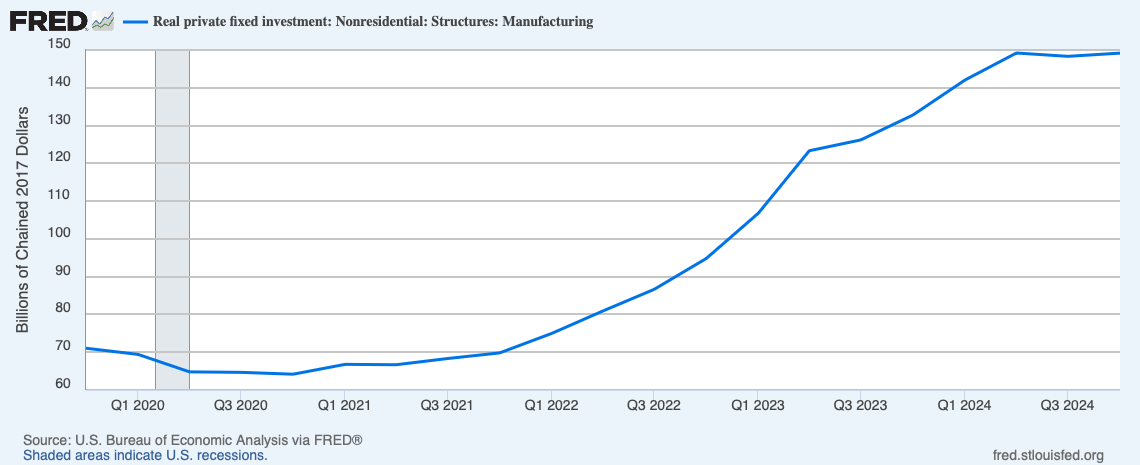

But the last four years were shockingly good for manufacturing investment in the U.S. Policy gave subsidies and incentives to bring manufacturing to the U.S. and companies have invested more in U.S. manufacturing in the last four years than any time in history, as you can see below.

Does that trend still hold or do tariffs reverse the onshoring of manufacturing? This may be the most important chart to watch over the next few years because if investment doesn’t go vertical tariffs are a failure.

We also don’t know what risks are hidden under the surface that will surface in an economic downturn.

Higher costs and a slowing economy are predictable in a high tariff environment.

Does that cause defaults on student loan payments?

Do tariffs and AI push a massive efficiency push in white-collar jobs?

Is multiple compression our biggest worry?

I can’t predict the unforeseen risks to the economy.

But I can predict something unforeseen will break if these tariffs stick.

How I’m Investing in 2025

I hope you’ve come away so far with a healthy level of fear/skepticism without being scared out of the market. Because uncertainty when the economy is on uncertain ground or when a recession begins is where opportunities lie for investors.

One of the changes I made to the Asymmetric Portfolio in 2025 was announcing I would double my investment into the portfolio any month the S&P 500 is down over 20%. I want to institutionalize being greedy when others are fearful. Today, I’m updating that with the following.

2x monthly investment if the S&P 500 is down 20% from its peak

3x monthly investment if the S&P 500 is down 30% from its peak

4x monthly investment if the S&P 500 is down 40% from its peak

5x monthly investment if the S&P 500 is down 50% from its peak

I will also be spacing out these purchases throughout the month, so if the S&P 500 is in a 20% drawdown on April 15 I will make buys and let premium subscribers know.

I’ll also share more about the discussions I’ll be having on Slice later this week.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.