We’re only a week out from the end of the first quarter and earnings season has ground to a halt. That’ll change next week when early auto sales and retail data is released, followed shortly by banks and big tech reporting earnings.

The pop that started the year is gone, and the market (or the Nasdaq, at least) is officially in correction territory, noted by a 10% drop in the market. We will see if fears of a recession in 2025 are legitimate when we start getting data about sales early in the year.

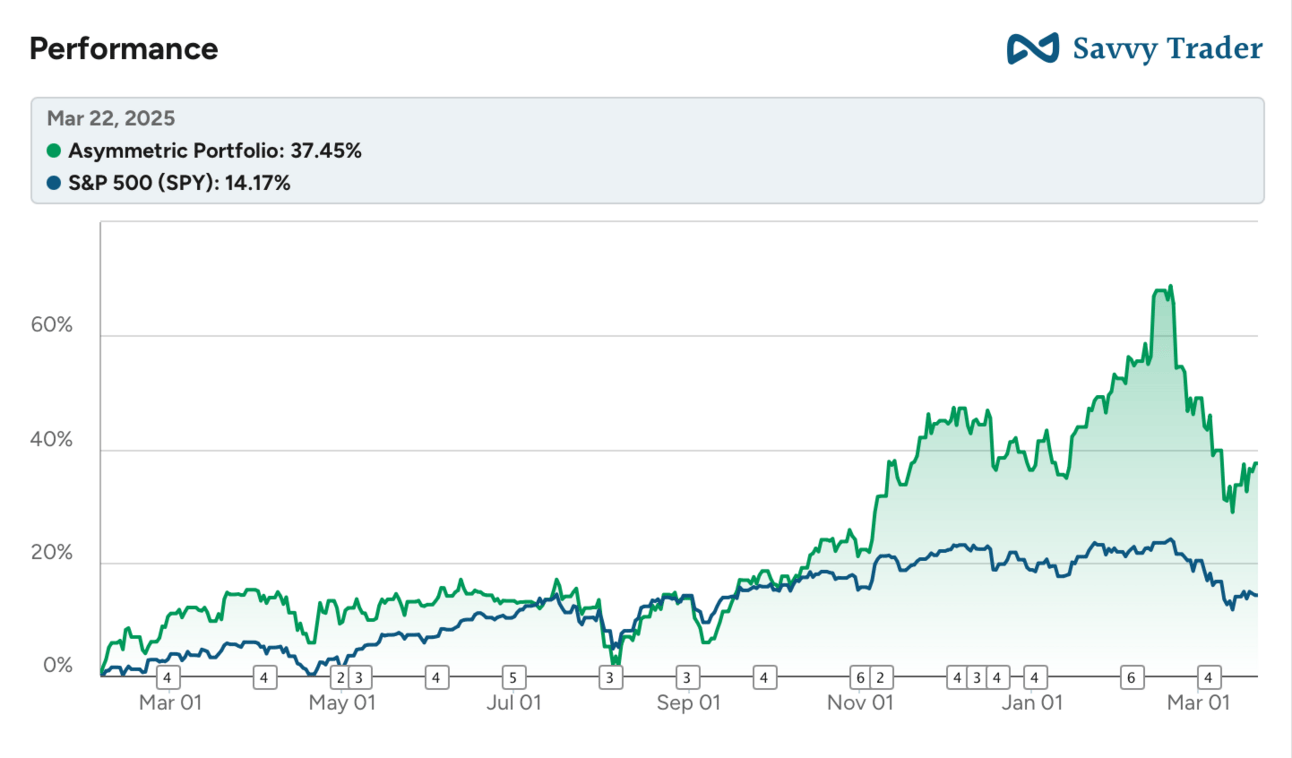

The Asymmetric Portfolio is now up 0.87% for the year, beating the S&P 500’s 3.77% decline. That doesn’t include the Tesla puts I bought in January, which are up 143% in two months.

Taking a bigger step back, the portfolio is beating the market by 37.45% to 14.17% since February 2024. I expect more volatility, but will use that as an opportunity to buy great companies for a discount if prices continue to fall.

What stocks am I adding to my market-beating portfolio each month? You can sign up for premium here to find out, get 2x the Asymmetric Investing content, and gain access to the market-beating Asymmetric Portfolio. What are you waiting for?

How do I make all of the charts in Asymmetric Investing? Simple. With Finchat. You can get started with FinChat Pro free for 2 weeks below. After that, you’ll get 15% off for being an Asymmetric Investing subscriber. I can’t say enough how much easier it’s made my research. Check it out 👇

In Case You Missed It

Here’s some of the content I put out this week.

Why Inflation is Good: I make the case for inflation…in moderation.

Gambling, Prediction Markets, and Robinhood’s Innovation: Is Robinhood a gambling app or are you seeing innovation in action?

Disney: The Growth Stock: I still see a bright future for Disney with new attractions opening at a steady clip over the next few years and ESPN’s streaming launch just a few months away.

Waymo’s Rise to the Top

The market still seems to think Tesla $TSLA ( ▲ 0.03% ) is in the lead in autonomy and Waymo, which is majority owned by Alphabet $GOOG ( ▲ 3.74% ), is well behind because it has higher costs and uses “expensive” technology like LiDAR in its vehicles.

Waymo’s vehicles are indeed expensive, but 30 years ago mobile phones were held in bags and cost as much as a mortgage payment.

History tells us that proven technology will get significantly lower cost as it scales. And Waymo has proven the technology and is starting to scale.

Today, Waymo operates in San Francisco, Los Angeles, Phoenix, and Austin with Atlanta and Miami launching soon. Not only do they operate in those cities, but the service area is expanding quickly.

Despite a relatively small footprint, Waymo is now competing over 200,000 rides per week.

The growth is rapid too. According to data from Yipit, Waymo went from 0% market share in San Francisco to 22% in a little over a year and you can see above that the service area is expanding quickly.

But costs are still a concern and there’s competition coming, so why could Waymo be building an insurmountable lead?

Scaling → Lower Cost

There are two major questions around autonomy today.

Who can safely build and deploy autonomy?

Only two companies — Waymo and May Mobility — have commercial operations in the U.S. today.

Who can build an autonomous fleet cost-effectively?

Waymo has chosen to answer #1 and I think has done so with flying colors. ~1 million rides per month and growing 20x over two years should grab anyone’s attention.

But the question around Waymo has always been about cost.

It’s estimated that Waymo’s vehicles cost between $150,000 and $250,000 apiece, which would likely make them uneconomical to operate even at high efficiency.

But making money today isn’t the point.

Waymo has taken a path of proving the technology and begin building the market, then leveraging higher volume and the natural deflation of technology costs to become economical in the future, starting a flywheel of lower costs in operations along with a network effect in its business.

On the cost side, this is a proven strategy in technology, exemplified by solar panels, which have seen costs fall over 99% in the last 40 years, or Tesla, who started with expensive vehicles in the Model S and Model X sold at a loss to prove the market and then moved down market and scaled the business with the Model 3 and Model Y.

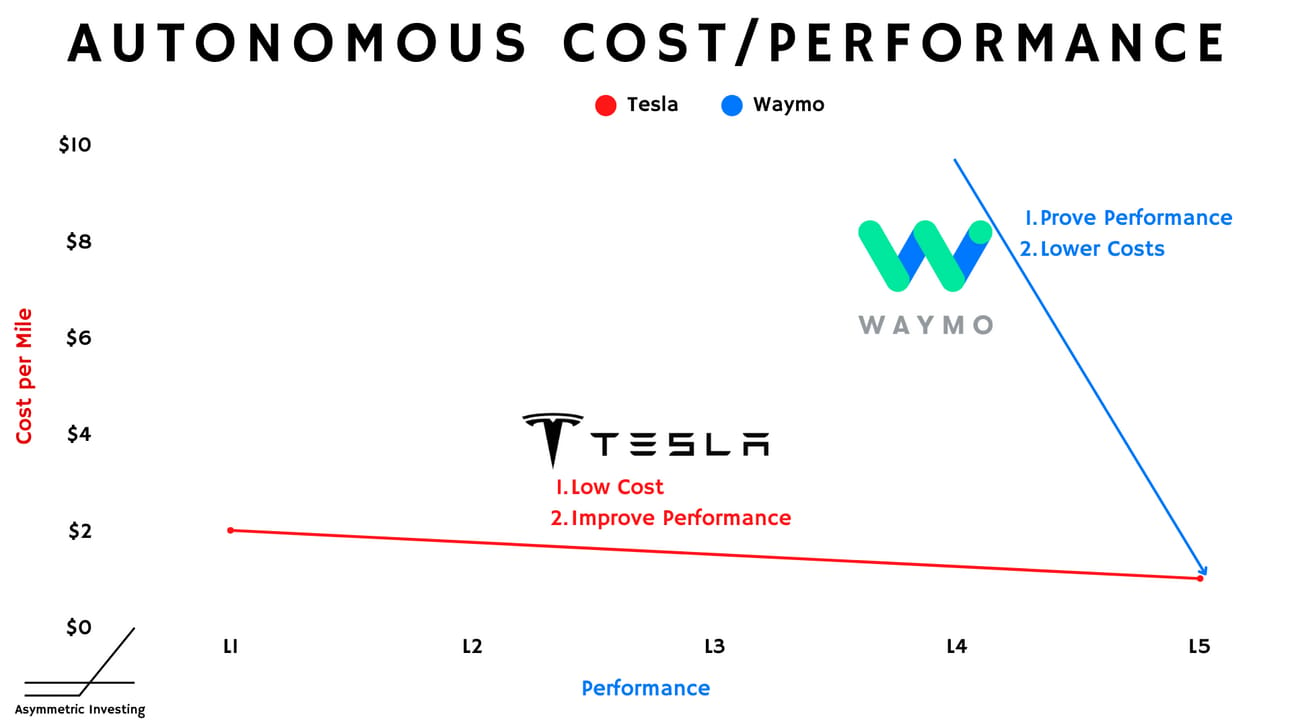

Ultimately, Tesla and Waymo want to get to the same point, but they’re taking different paths to get there.

Interestingly, Tesla has taken the opposite approach to autonomy, choosing to focus on costs and figure out technology later.

I would argue that Mobileye is taking a similar approach to Tesla, building an economical system and hoping to scale through partnerships with multiple OEMs.

The question is, who will get to economic autonomy first?

Waymo’s path is clear.

The hardest part — proving autonomy and building a ride-sharing network — is a solved problem.

Lowering costs is “relatively easy” and Waymo has low-hanging fruit from building vehicles at scale, designing a vehicle with sensors and compute designed and built from the ground up, and operating its fleet at scale.

Tesla, Mobileye, and everyone else in autonomy have a more difficult path trying to compete with a proven solution that’s now offering commercial rides in four cities with at least a half dozen cities launching this year.

Don’t sleep on Waymo’s long-term potential to lower costs faster than competitors can catch up in technology. For Alphabet, it’s a great call option on a potentially massive market and an underappreciated business for investors.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.