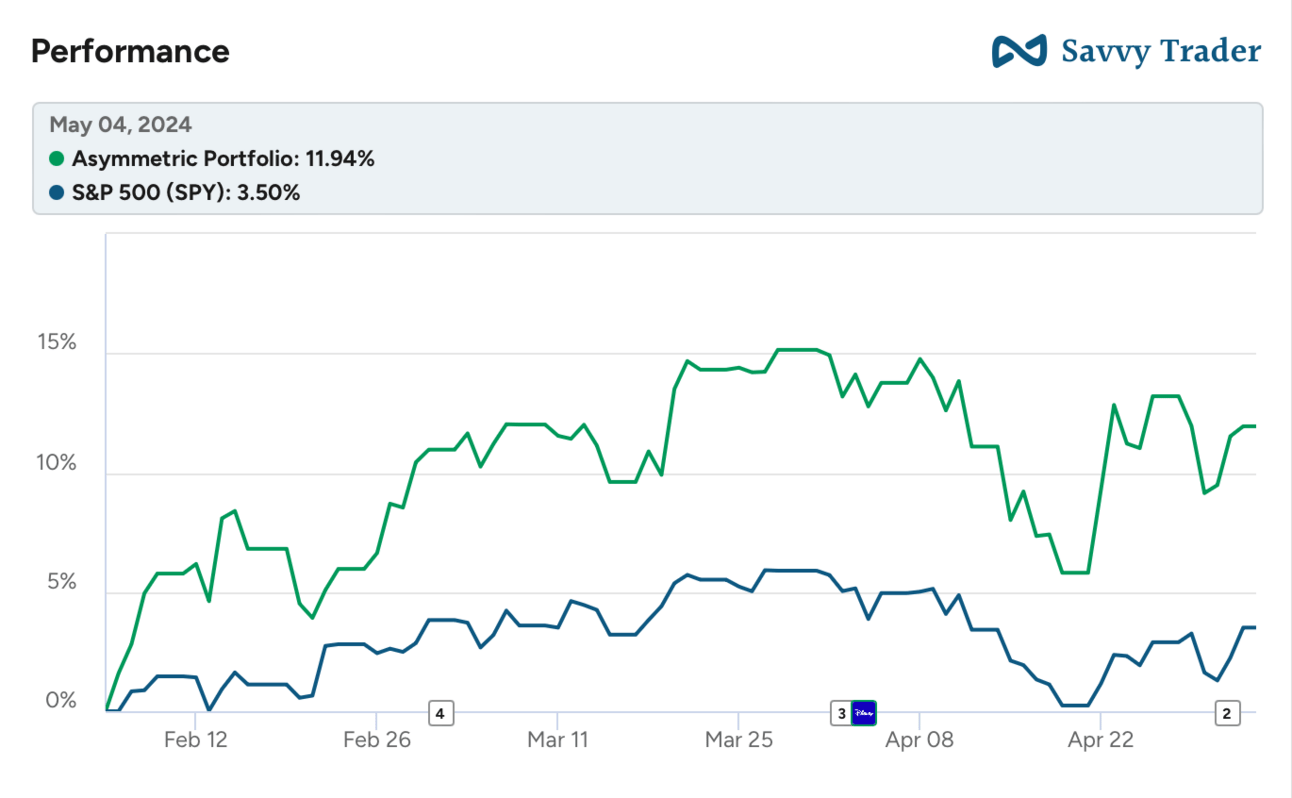

A barrage of earnings reports this week sent the stock market into a frenzy. You can see below the reaction was negative for most of the week but Apple’s report after the market on Thursday sent stocks higher Friday along with a weak jobs report.

On the jobs front, a weaker economy is bad for growth and earnings, but traders overlooked that, hoping interest rate cuts are cut by the Federal Reserve later this year. That doesn’t make much sense if you’re a long-term investor like me, but that’s how the market thinks short-term.

As for Apple’s report, I’ll get to that below.

The week was volatile for the Asymmetric Portfolio and individual stocks were all over the place, but as a whole, it essentially mirrored the market.

Asymmetric Investing has a freemium model. Sign up for premium here if you want to skip ads and get double the content, including all portfolio additions.

Whiskey Investing: Consistent Returns with Vinovest

It’s no secret that investors love strong returns.

That’s why 250,000 people use Vinovest to invest in fine whiskey.

Whiskey has consistently matured and delivered noteworthy exits. With the most recent exit at 30.7%, Vinovest’s track record supports whiskey’s value growth across categories such as Bourbon, Scotch, and Irish whiskey.

With Vinovest’s strategic approach to sourcing and market analysis, you get access to optimal acquisition costs and profitable exits.

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

What I’m Buying Today: The stocks I’m acquiring for the Asymmetric Portfolio in May.

Zuckerberg vs Altman in AI: As business models emerge in AI, Sam Altman’s OpenAI looks like it’s in a losing position.

Asymmetric Portfolio Earnings Recap: My thoughts on a few of the earnings reports this week.

SoFi — Abandon Ship or Buy the Dip?: SoFi sold off after earnings, but is that the right reaction?

Why Do Companies Buy Back Stock?

Apple’s stock jumped 6% on Friday after announcing a $110 billion buyback plan, the largest in corporate history.

Incidentally, Apple added $160 billion in market value based on the news.

The reaction seemed to overlook the fact that Apple’s revenue was down 4% and the company hasn’t been growing for years. I think it’s clear Apple’s best days are behind us.

For this post, I want to ask if buybacks are a good use of capital for Apple and what the difference is between a good buyback and a bad buyback.

Apple’s Bad Buyback

When stock can be bought below a business’s value it is probably the best use of cash.

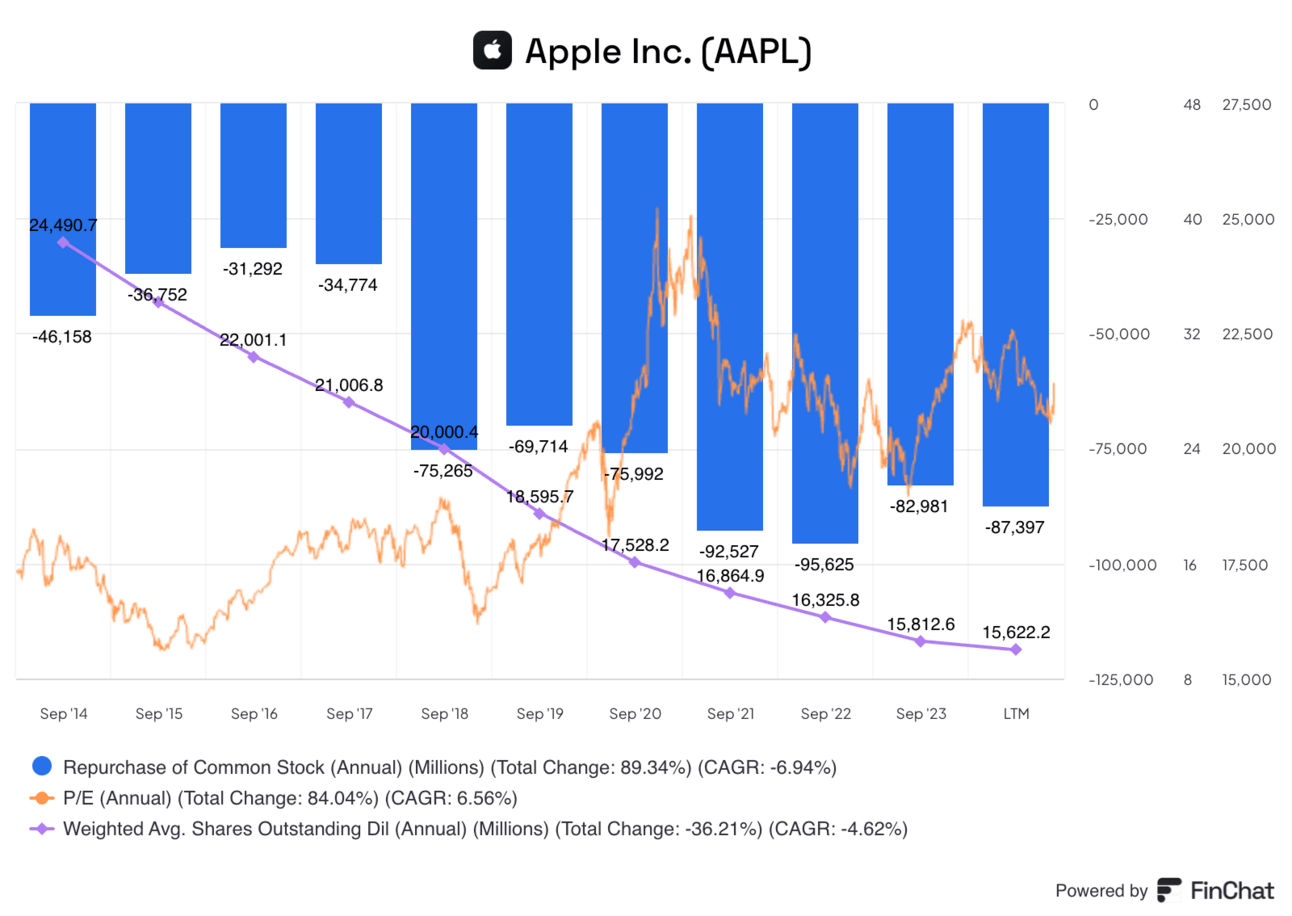

Apple isn’t new to buybacks. You can see below that Apple has been buying back stock for more than a decade and that’s helped it reduce shares outstanding by 36%.

Buybacks helped fuel the stock increase over the past decade.

But look at the pace of buybacks compared to the amount spent. When Apple bought back shares from 2014 through 2019, it bought shares for a price-to-earnings multiple between 10 and 16. Put another way, the yield on spending all of its cash on buybacks would be between 6% and 10%. Not bad in a zero interest rate environment.

Today, the P/E ratio is 29 and the yield on buybacks is about 3% in an environment where Apple could get 5.5% by just hanging on to cash.

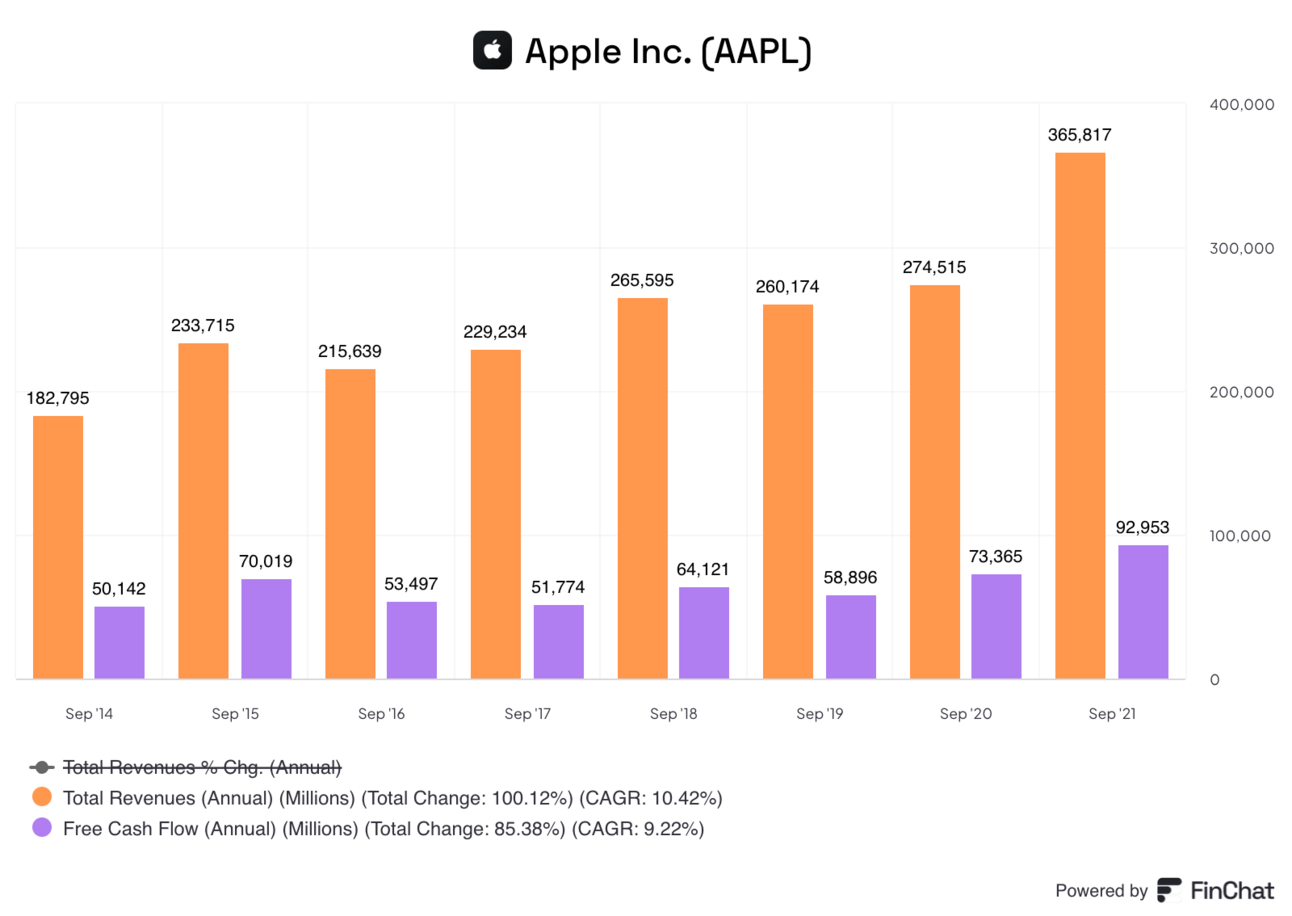

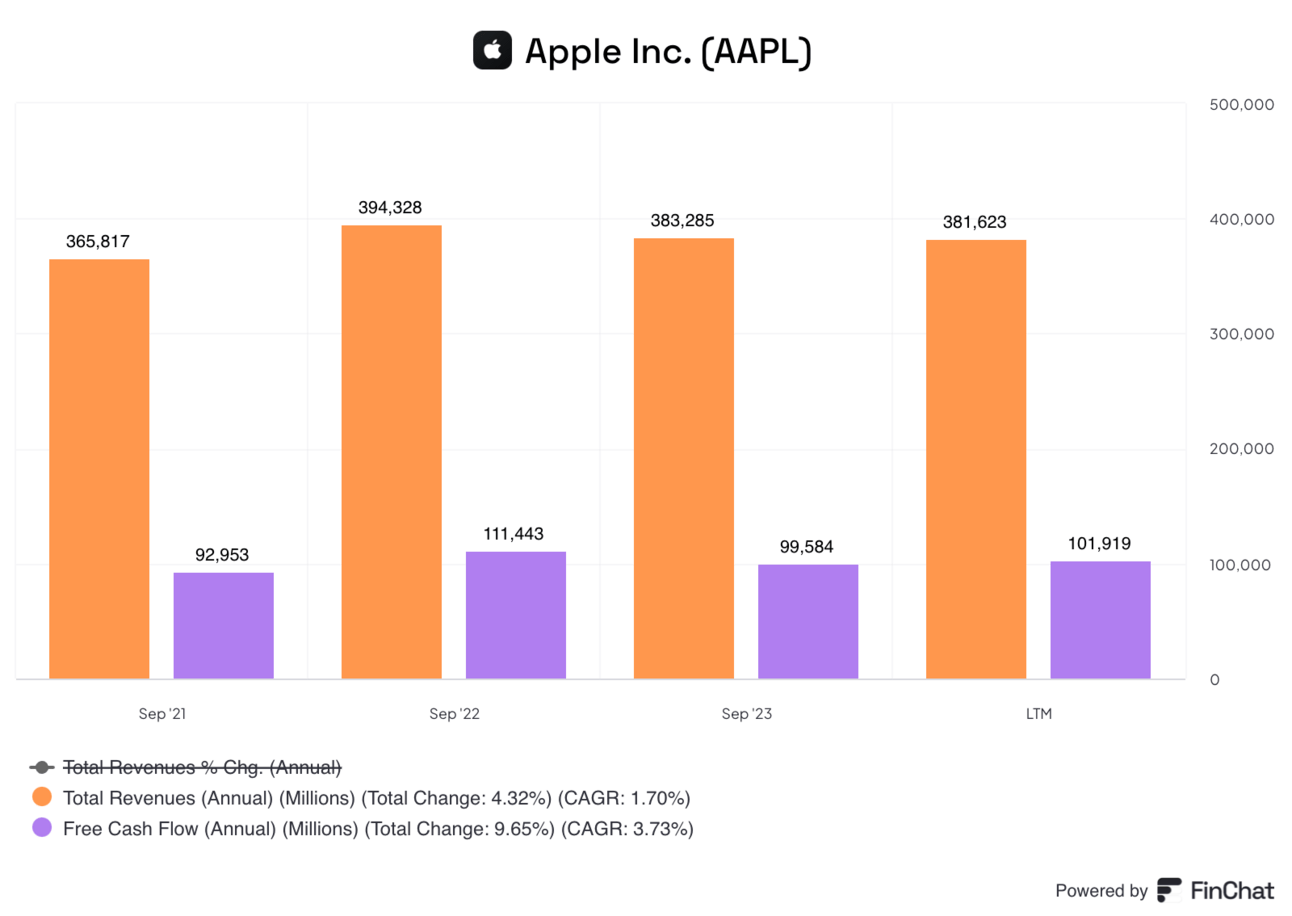

Not only is Apple stock more expensive than it was a decade ago, the business is in worse shape. Between fiscal 2014 and 2021, Apple’s compound annual growth rate was 10.4% and free cash flow grew at a 9.2% rate.

Since then, growth has stalled and is on the decline since fiscal 2022 when the pandemic impact on smartphone sales peaked.

I could go further into how Apple’s business is only growing because it’s squeezing more from developers and users in the form of services revenue while more important hardware sales are falling, but you get the point.

I think Apple buying back $110 billion of stock is a bad buyback. The company is doing so because at that scale the choice is to buy back stock or pay a dividend and buybacks are the easy choice.

At today’s price, $110 billion will buy back about 3.9% of Apple’s stock. That’s unimpressive if you ask me.

Better Buybacks

When I look at buybacks, I want to see a company trading for a value that’s generating cash and has exhausted growth and acquisition opportunities.

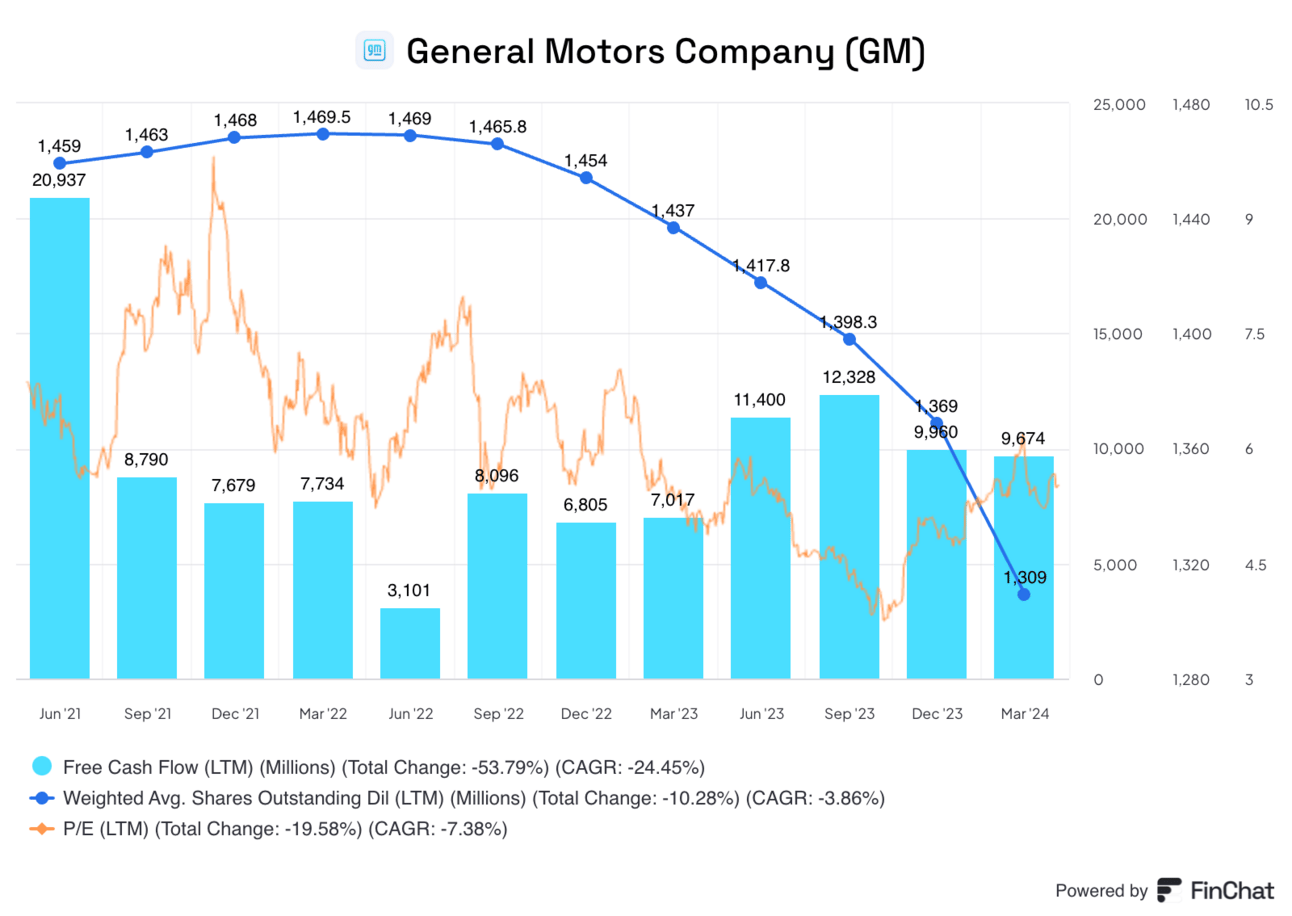

Take GM as an example. It bought back 22% of shares outstanding in the past two years (1,140 million shares were outstanding on April 12, 2024) and is accelerating purchases. There’s excess cash coming from the auto business and management is being prudent in not over-investing in EVs or Cruise.

Why not buy back stock at 4.5x earnings?

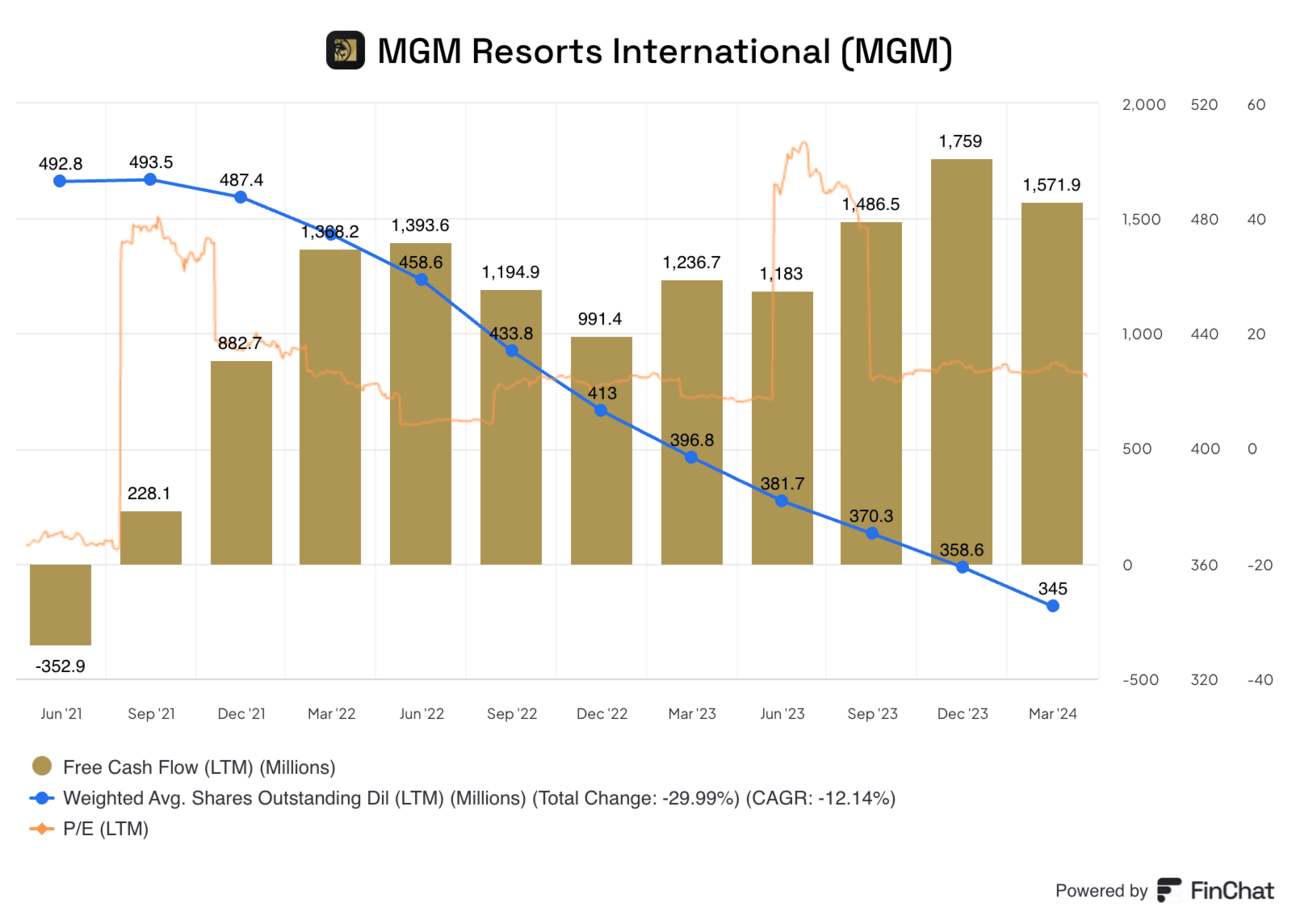

MGM Resorts is doing the same.

The stock is trading for about 13x earnings and 7x free cash flow, so management is buying stock aggressively. But there’s also enough cash to invest in online gaming and a Japanese casino that may cost $10 billion by the time it’s completed in 2030.

GM and MGM Resorts are executing great buybacks because they’re buying stock at a value, not when it’s overvalued.

Buybacks can be a great way to return capital to shareholders and push a stock price higher, but only when they’re done effectively.

Apple buying back shares at 29x earnings when the business is starting to decline tells me management doesn’t know what to do with cash since innovation plans (car and VR) aren’t working.

GM and MGM buying back shares at single-digit prices to free cash flow multiples tells me they see an opportunity the market is overlooking.

The latter is a much more Buffett-like approach to buybacks. I don’t think it’s any coincidence Buffett has been selling Apple stock and I have too.

What are you waiting for?

You can get all Asymmetric Investing content, including deep dives, stock trades before they’re made, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.