A quick note to start:

The January 2024 Spotlight Stock was up a whopping 38% this week and it’s still just a $53 million company.

If you want to know more about that stock and find out what I’m buying on February 1, 2024, sign up to be a premium subscriber. You will get notified of trades before they’re made and learn more about a spotlight stock each month.

I hope you had a wonderful week!

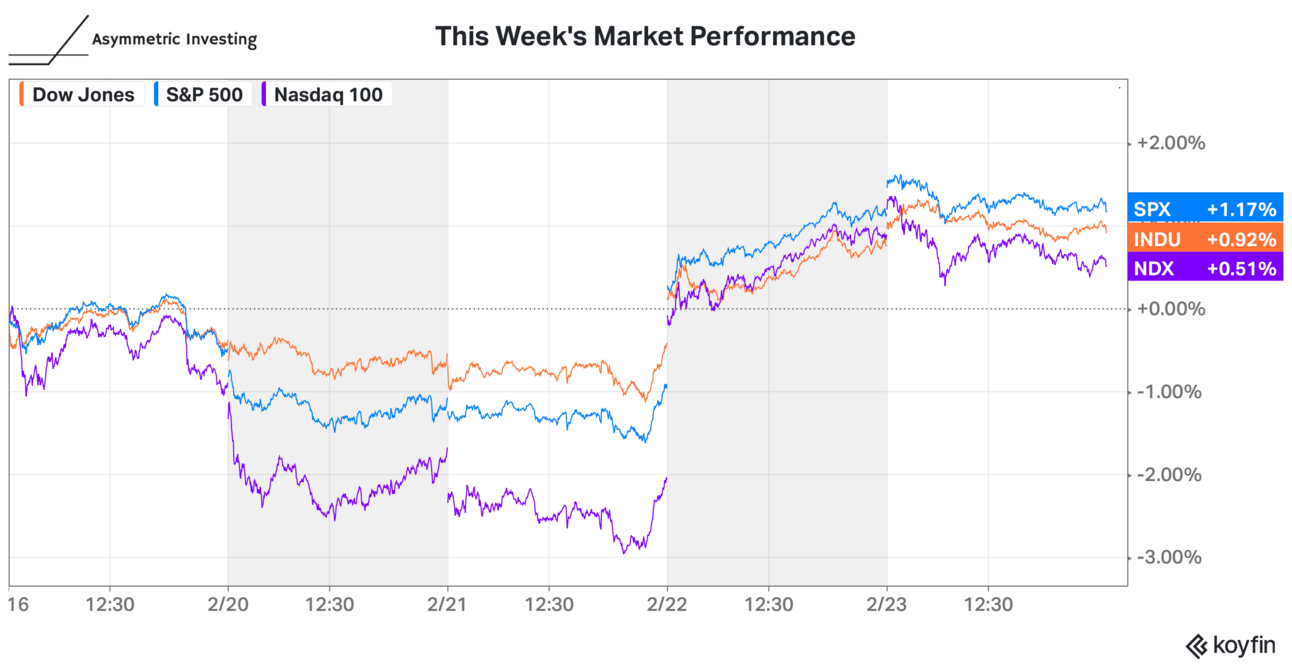

The stock market had NVIDIA on the mind this week and you can see by the performance of stocks on Thursday the chipmaker did not disappoint. If you want to know more about NVIDIA, I suggest videos from Jose Najarro and Nick Rossolillo.

I’ll take a wider look at the broader market’s performance below.

In Case You Missed It

Here’s some of the content I put out this week. Enjoy!

AI and the Scorched Earth Theory: AI is the hot topic right now but a lot of tech companies have an incentive to give away AI technology to protect their existing products. If that happens, it may be harder than you think to find value in the market.

Earnings Update: Review of what happened with Asymmetric Universe stocks this week.

Rivian Is In Serious Trouble: This is supposed to be a growth company, but it won’t grow while burning nearly $5 billion in 2024.

Coinbase is Unstoppable: Earnings showed momentum on multiple fronts at Coinbase.

Beyond NVIDIA The Market Is…Uncertain

The stock market seems to be moving in lockstep with NVIDIA right now as investors continue to see a bright future in AI infrastructure. But beyond AI, earnings season has been a little more tepid.

Consumers seem to be pulling back, higher rates are starting to have an impact on large purchases, and competition is heating up in certain parts of the market. Here are a few results from this week that provide a little more context to the mood in the broader economy.

Retail Clues

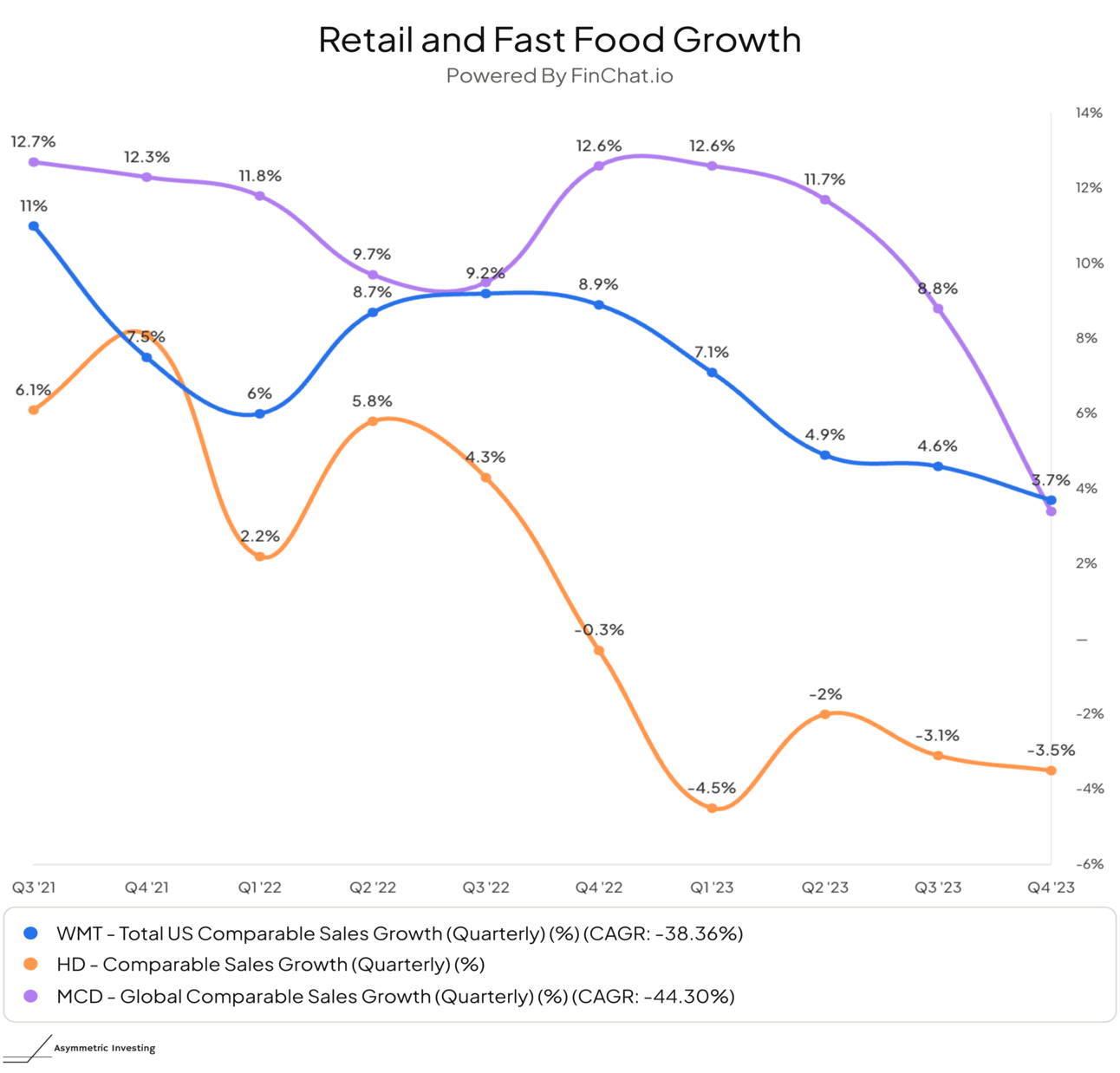

When retailers and restaurants are generating more revenue from each store it indicates strong demand and growing earnings.

In the last few quarters, we’ve seen deterioration in growth at bellwether companies like Walmart, Home Depot, and McDonald’s. You can see below that same-store sales growth at each company is falling and Home Depot noted this week that sales of higher-priced items are down as consumers do smaller renovation projects.

An Auto Slowdown

If people are cutting back on home remodels, it makes sense they’re also cutting back on high-priced auto purchases. And that’s what we saw from Rivian and Lucid this week.

Rivian said its production would be about flat in 2024 with just 57,000 vehicles expected to be produced.

Lucid produced 2,391 vehicles in Q4, but only delivered 1,734 to customers and expects to produce 9,000 vehicles in 2024. So, it’s slowing production from the Q4 pace.

This could be an EV-specific problem as the industry deals with supply rising faster than demand, but it certainly looks like we’re seeing spending on new cars getting weaker across the board.

This could have a cascading impact on the economy from raw materials to jobs given the sheer size of the auto market.

Casinos Tell the Story

How much are people spending on discretionary items like gambling? One proxy to look at is regional gaming (non-Las Vegas Strip) and there was a lot of weakness in the quarter.

Caesars’ regional gaming revenue was flat.

MGM’s regional gaming revenue was down 12% (blamed on the strike and a single whale losing less money than a year ago).

Penn National’s revenue dropped 12%.

Boyd Gaming’s in-person revenue fell slightly.

These four companies encompass most non-Las Vegas casinos in the U.S. and their results aren’t even keeping up with inflation.

Tech Is Great, But Consumers Drive the Economy

These broader data points tell the story of a consumer that’s at least pulling back a little. People are spending less on “nice to have” items like new vehicles, home remodels, and gambling as “must haves” like housing and food eat up more of the budget.

If you listen to enough conference calls, you’ll hear a similar story. Even when companies are growing, they’re seeing weakness in important pockets.

What’s odd is that the market doesn’t seem to care. The Nasdaq 100 (dominated by big tech) is up nearly 50% over the past year and even the Dow is up 18.4%.

The truth is that NVIDIA is a market outlier right now, growing at an insane rate because of the AI buildout.

But look at results from Apple and Tesla and you see low single-digit growth rates. Meta Platforms has made a massive recovery on the stock market, but revenue has only grown at a single-digit compound rate over the past two years and the market has been cheering massive layoffs.

Amazon and Google have also seen growth rates slow in 2023 from historical norms.

My point is, that the earnings story isn’t clear when you move beyond NVIDIA. There are signs of strength and signs of weakness.

But the market is acting like we’re in a boom time and I don’t see evidence that consumers feel the same way. And as 70% of the economy, they matter more than NVIDIA long-term.

Something to keep in mind…

You can get all Asymmetric Investing content, including deep dives, stock trades before they’re made, and ongoing coverage of Asymmetric Universe stocks like Airbnb with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.