Every once in a while, I’m reminded that many investors haven’t lived through a normal recession or market decline in their investing lives. 2020 doesn’t count, in part because the market recovered in a few months and there was nothing “normal” about 2020.

2008 and 2009 were the last real recession we had in the U.S. and someone who started their investing journey at the market bottom in 2009 at 22 years old would now be 38 years old!

To say that the last 16 years of stability and prosperity for investors are an outlier would be an understatement. The only major pullbacks in that time were a short drop when COVID hit and the popping crypto/SPAC/ZIRP speculation in 2022. But there hasn’t been a normal recession since 2009.

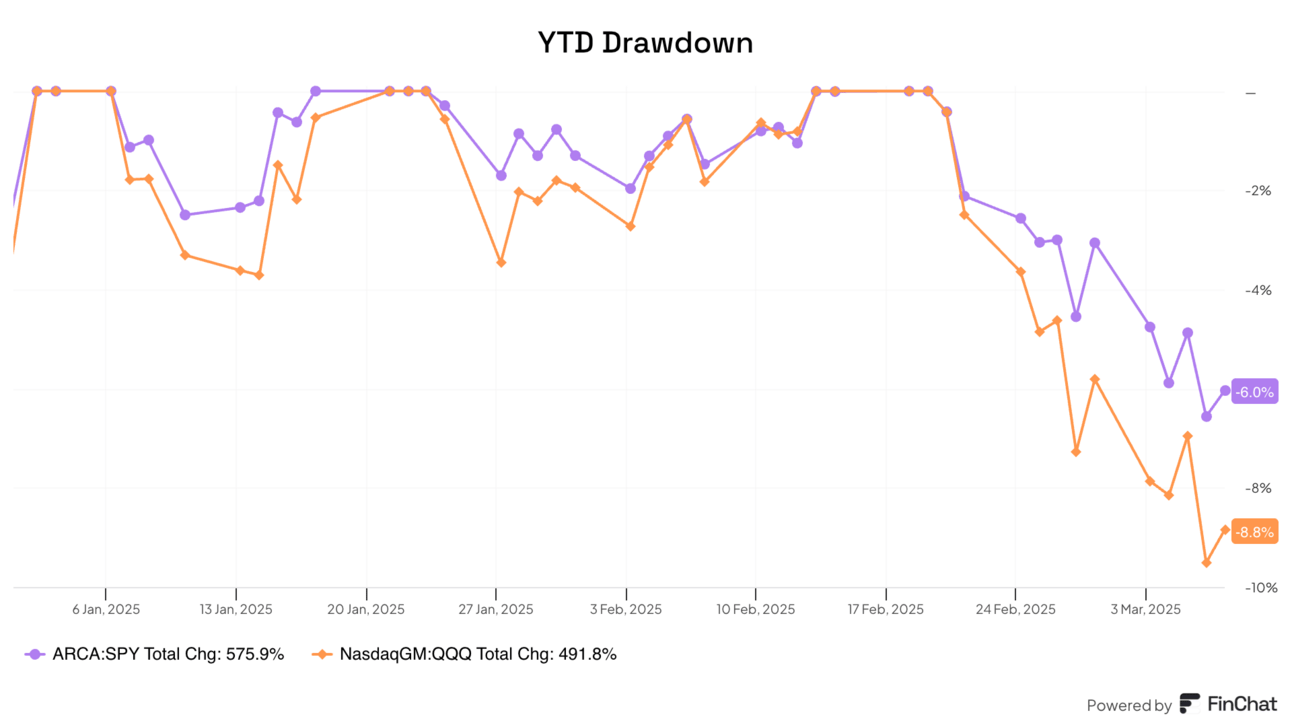

Zoom out to the beginning of the century and the last 16 years look like a dream. From the peak in the 2000, the S&P 500 (SPY) fell 56.5%, and the Nasdaq 100 (QQQ) fell 83% and didn’t recover its losses until 2016.

In 2008/2009, the S&P 500 fell 56.5% and the Nasdaq 100 dropped 53.6% from their 2007 peaks.

It’s easy to see this year’s drop in stocks as dramatic and I’m seeing a combination of fear and “buy the dip!” mentality. But keep in mind the chart above when you think an 8.8% drop in the market is big. Stocks are down, but this is nothing!

I have made similar points before on Asymmetric Investing and I may sound like a broken record because I’m trying to instill that stocks can fall a lot further and it’s how we react at the worst of times that will determine if we beat the market long-term. I love the research of investing, but this is a mindset business.

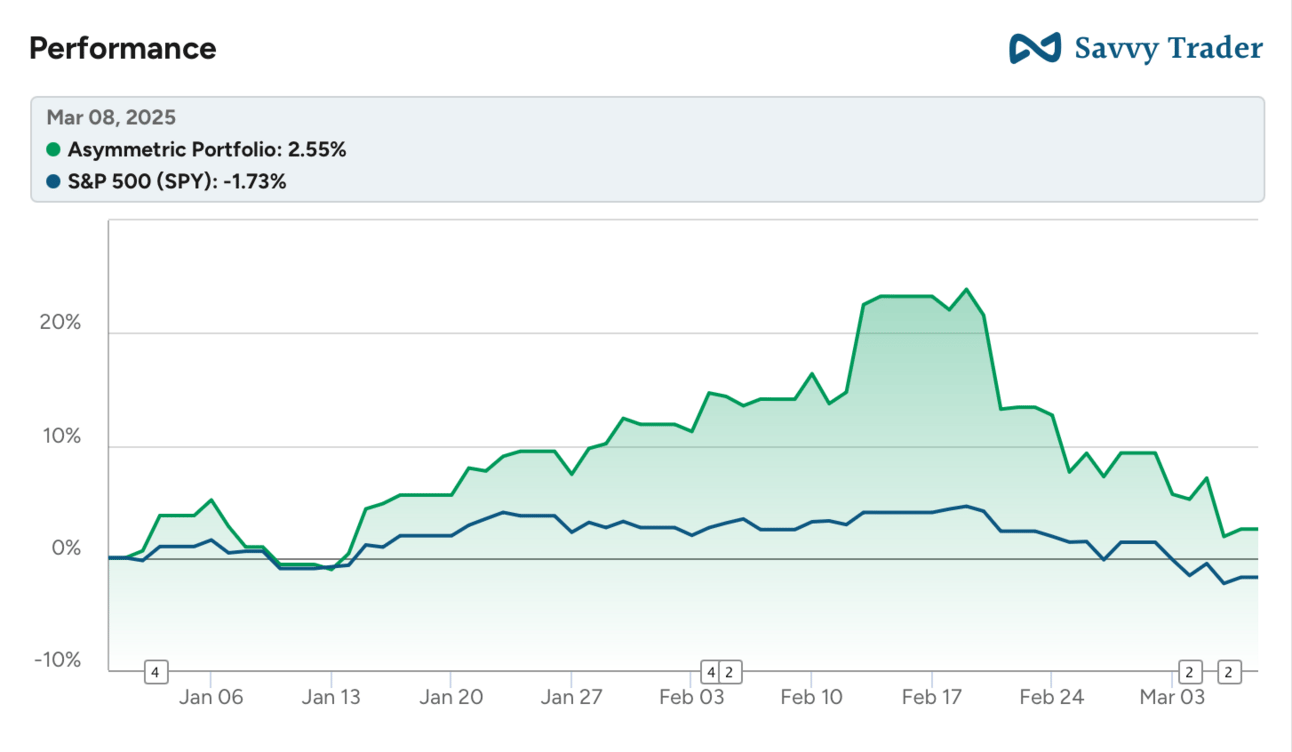

The Asymmetric Portfolio is still beating the market so far this year, but the gap has closed significantly as some of the largest positions in the portfolio fall. This volatility does nothing to change the fundamentals of how I’m investing long-term and I’m not selling great businesses because they’re coming off artificially high peaks.

I was getting cautious early this year though and that’s why I put on the “Special Situation Short” of Tesla, which is up 104% in a little over a month. I still think this is a good hedge against any economic decline and Tesla’s business looks to be deteriorating faster than I could have thought with sales in Europe and China both down nearly 50% this year.

What stocks am I adding to my market-beating portfolio each month? You can sign up for premium here to find out, get 2x the Asymmetric Investing content, and gain access to the market-beating Asymmetric Portfolio. What are you waiting for?

How do I make all of the charts in Asymmetric Investing? Simple. With Finchat. You can get started with FinChat Pro free for 2 weeks below. After that, you’ll get 15% off for being an Asymmetric Investing subscriber. I can’t say enough how much easier it’s made my research. Check it out 👇

In Case You Missed It

Here’s some of the content I put out this week.

Rich People Sh*t: Where can you find great investment ideas? Look for companies making stuff for rich people available to the masses.

Update on Owlet, Figs, and Tesla: I updated premium subscribers on my thoughts from the fourth quarter of 2024.

Spotlight on Joby: Speaking of rich people sh*t. What if you could get a helicopter with private jet range with your Uber app?

High Valuations Meet Economic Uncertainty

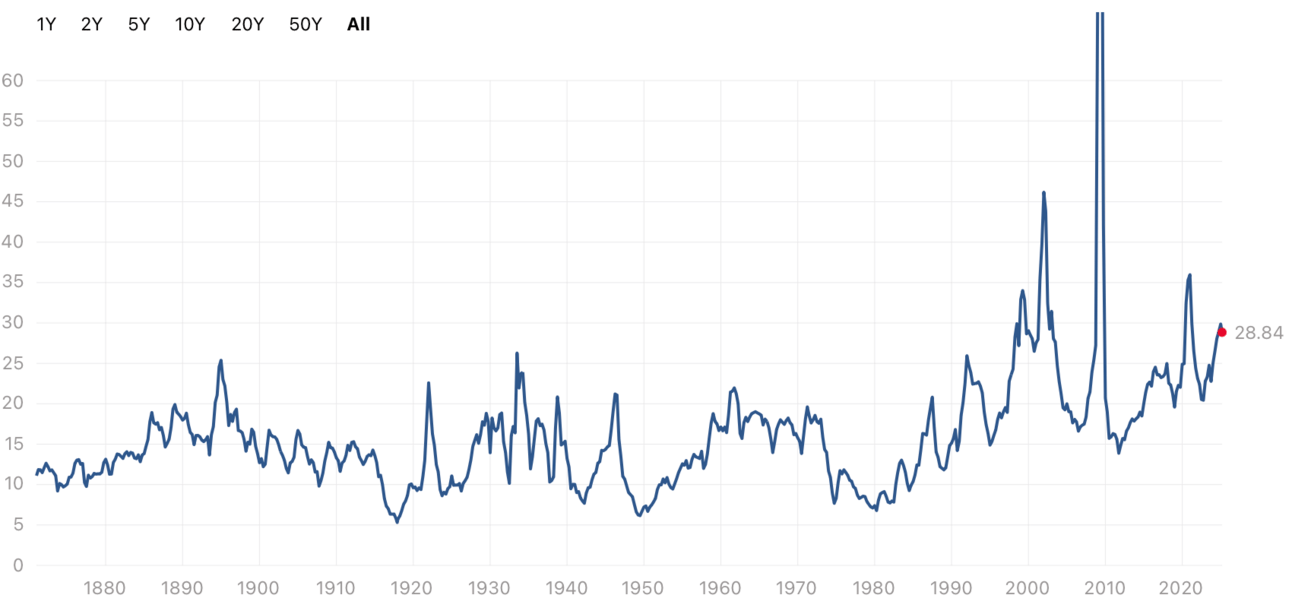

I’ve used this chart of the P/E ratio of the S&P 500 before, but it’s worth highlighting that we’re still near historic highs in stock valuations, despite the recent pullback. There was no time before 1998 that stocks were this expensive and they’ve never been this pricy in non-recessionary times (when the “E” in P/E falls).

Those high valuations are meeting the economic uncertainty of today. Guidance for most companies was tepid, to say the least. And retailers were sounding alarm bells that consumers are cutting back.

This can be a noisy chart, but the Atlanta Fed’s GDPNow estimate thinks we will see a decline in GDP in the first quarter. Falling auto sales alone may be enough to push GDP negative.

And so the market goes from greed to worry. This is normal volatility for stocks and we shouldn’t shy away from it.

Our job now is to build conviction in the companies we want to buy hand over fist if the market really collapses. In March 2009, I bought Las Vegas Sands and Apple at the bottom (yep, a 2-stock portfolio).

Today, I have a list of 21 stocks in the Asymmetric Universe that I would be happy to buy if shares fall 20%, 30%, or more.

When everyone was greedy late in 2024 and early in 2025, I was getting fearful. That’s why I added the first short position in Asymmetric Investing.

I’m not getting greedy yet, but I’m preparing to get greedy if a falling market hits and gives us some great buying opportunities.

You can get all Asymmetric Investing content, including deep dives, stock trades, and ongoing coverage of Asymmetric Universe stocks with a premium membership.

All for only $100 per year.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.