In a world full of software that can be launched in beta and updated in real-time, we’ve lost sight of how important (and hard) it is to execute hard goods product launches. Timelines matter, the amount of capital investment matters, margins matter, and ROI matters, just to name a few.

In other words, execution matters!

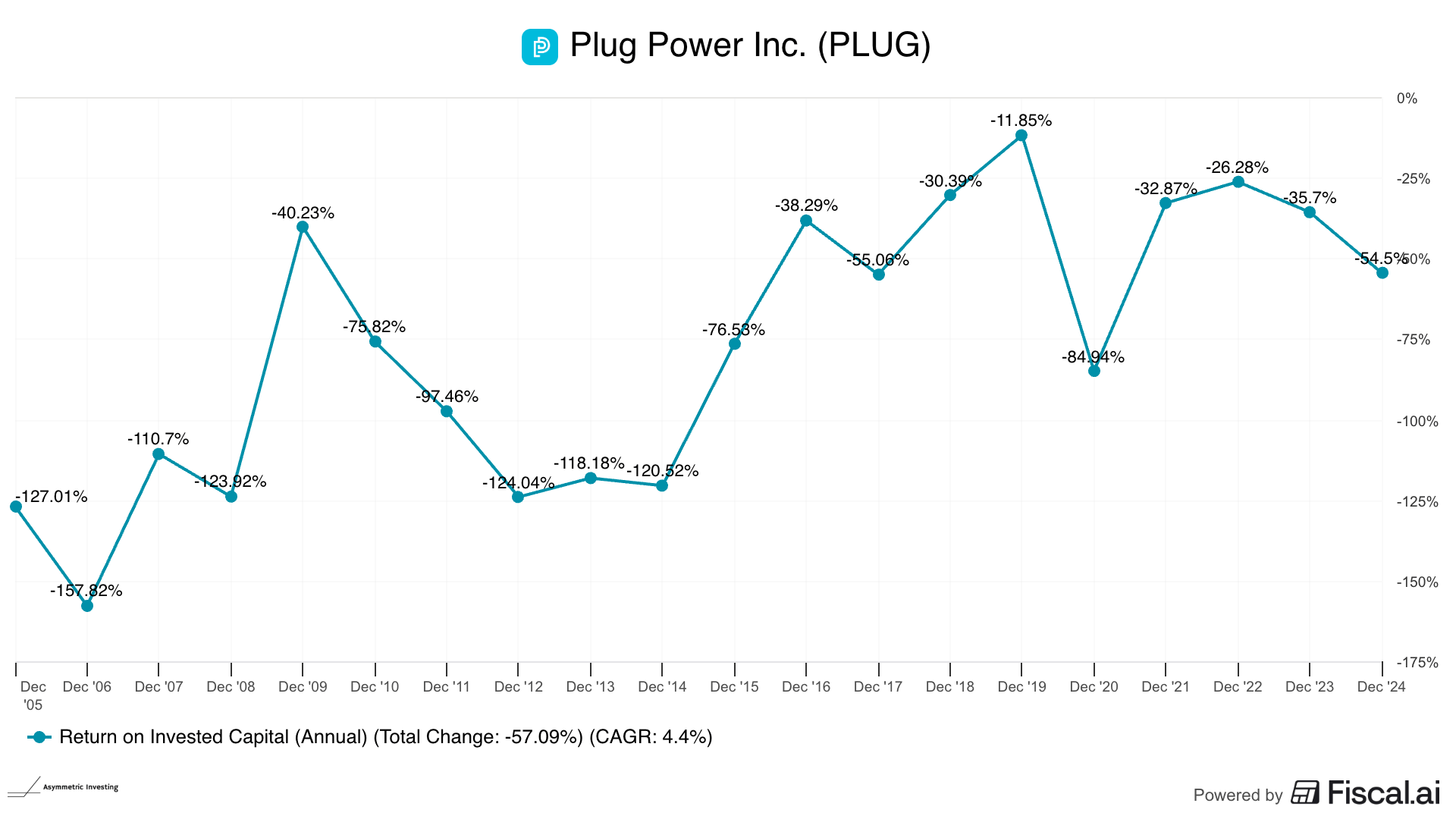

And yet, we’ve forgotten about execution and replaced it with the “story” in our investment thesis. I like a good story, like how hydrogen will be of growing importance in the future, but without execution on that vision, you have a company that loses money year after year after year, like Plug Power.

In my view, too many companies have become story stocks without the execution to back them up. And as I look for asymmetric opportunities, I’m avoiding some popular names because their execution doesn’t match their story.

Unlimited Upside & Upside Limits

One of the things I think investors get wrong about the physical vs digital world is the upside.

I’m selling a digital product here on Asymmetric Investing.

I could have 5 premium subscribers or 5 billion premium subscribers, and it wouldn’t change the capital I need to invest in the business. It’s literally unlimited upside as a business model. This is why digital businesses can be so profitable.

Making physical goods is entirely different.

There are upfront investments in design, capacity, sales, and marketing, to name a few.

That investment needs to be matched with product design, pricing, and launch timelines. It’s about executing a vision.

Even when it all goes right, margins can be thin. And upside is limited because manufacturing capacity is usually limited.

Misteps can be fatal.

This is why seasoned investors often balk at the idea of investing in an auto or telecom company. The capital invested can be astronomical, and it’s only a good business when everything goes right.

And sometimes we forget those lessons.

I want to go over two companies that have shown us time and time again they are poor at executing their vision in the physical world. And the numbers back up that story.

No surprise, I have a position in both.

Rivian’s Narrative vs Reality

Rivian $RIVN ( ▼ 1.19% ) makes trucks and SUVs. They’re very stylish. They appear to be high quality (in limited history). Rivian even makes software that VW is going to use in upcoming EVs.

But Rivian is an auto company.

It has the same constraints and capital requirements as companies like Ford and General Motors, yet investors seem to be enamored by the potential of the upcoming R2 launch and an autonomous driving software that’s no more capable than a dozen other companies can offer.

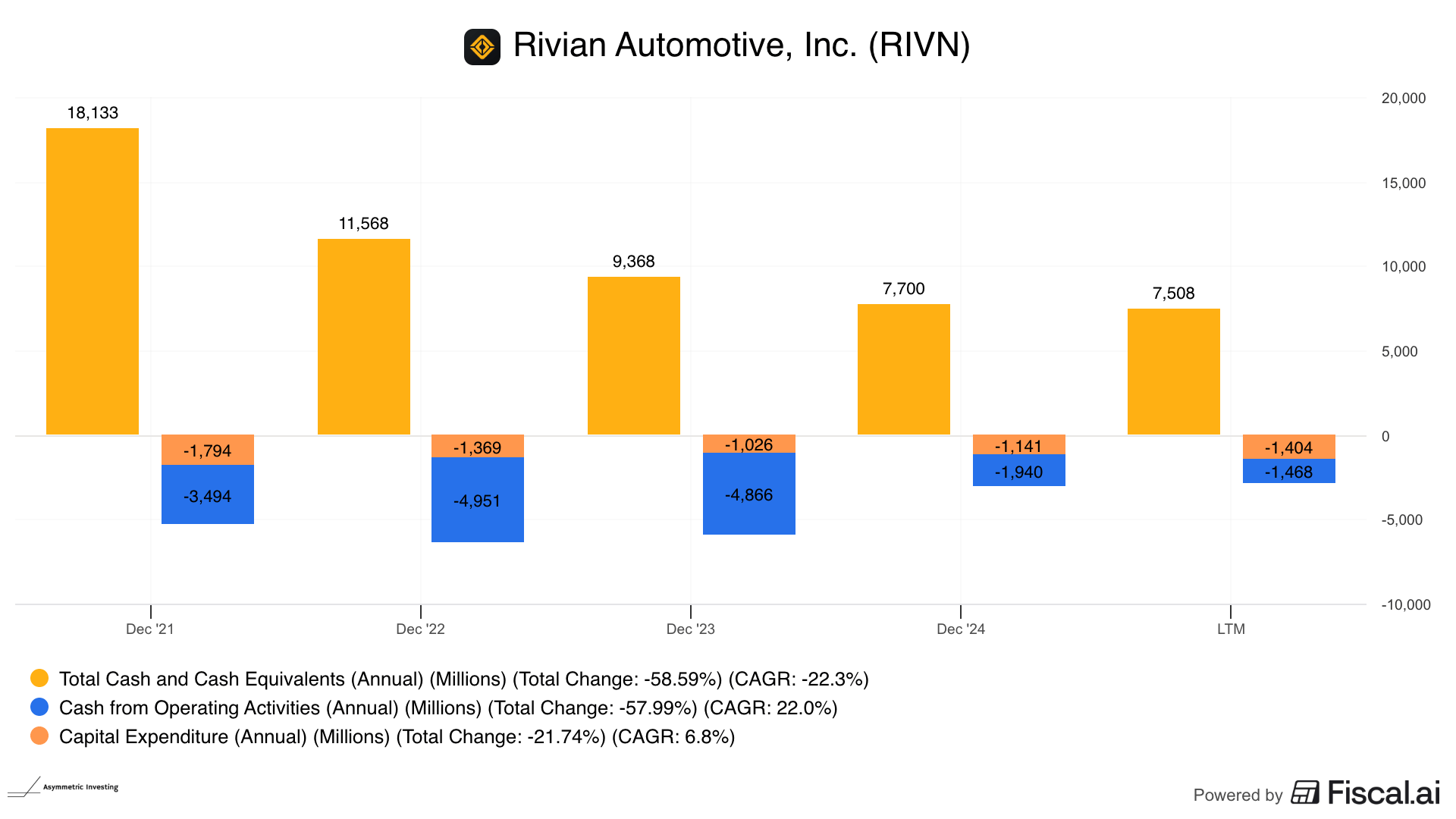

But what’s most shocking about Rivian is how horribly the company has executed its business since going public. The company went public in 2021, shortly after selling its first vehicle, and while an expected ramp was slow, the vision was to sell over 200,000 vehicles in relatively short order.

Over the course of fiscal year 2022, we plan to remain focused on ramping up production of both the R1 and RCV lines in Normal, as well as investing in our technology and product portfolio for future growth. We believe that throughout 2022, the supply chain will be a fundamental limiting factor in our total output for the Normal Factory and that our manufacturing equipment and processes would have the ability to produce enough vehicles to deliver over 50,000 vehicles across our R1 and RCV platforms in 2022 if we were not constrained by our supply chain. Our confidence comes from the demonstrated performance of our processes and equipment which is in line with our expectations.

OK, 50,000 units of capacity in 2022 once the supply chain gets sorted out. But that was just the start. The plant Rivian bought from Mitsubishi Motors had the capacity to build over 200,000 vehicles annually.

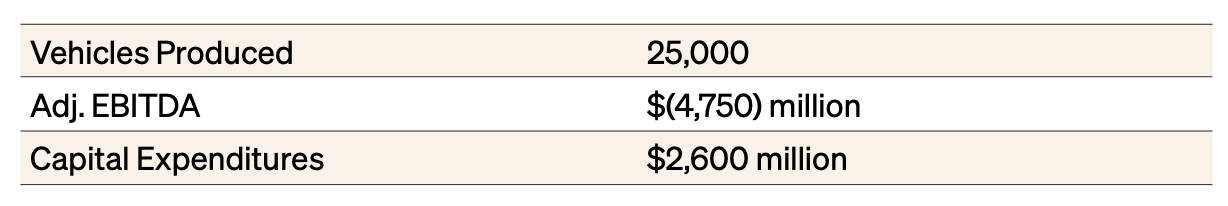

We plan to continue investing in our business throughout 2022 and therefore expect an increase in capital expenditures as compared to 2021. Capital expenditures are expected to be $2,600 million, driven by additional investment in our Normal Factory to expand the total capacity to 200,000 units annually.

Getting to that capacity in 2022 would have been asking a lot. But the company’s capex was “driven by” investments in expanding capacity toward 200,000 units each year.

Where does Rivian stand more than three years later?

There are problems on both the supply and demand sides.

Lowered Expectations

As of March 8, 2022, Rivian indicated to investors that it had 183,000 units of demand between R1 pre-orders and the 100,000 EDVs Amazon had ordered.

And look at the “total planned annual capacity” number in key highlights. That’s 200,000 units of capacity in Normal, Illinois, and 400,000 units in Georgia. There’s no timeline for 600,000 units, but they gave these numbers more than three and a half years ago!!!

In more than three years of production, the company has only produced 152,650 vehicles, and it isn’t running at full capacity today.

The demand Rivian indicated in 2022 didn’t really exist.

And Rivian’s supply has been constrained by its own mistakes.

This is something we see over and over again with Rivian’s guidance. In 2022, the company expected to produce 25,000 vehicles. It only made 24,337.

2022 guidance

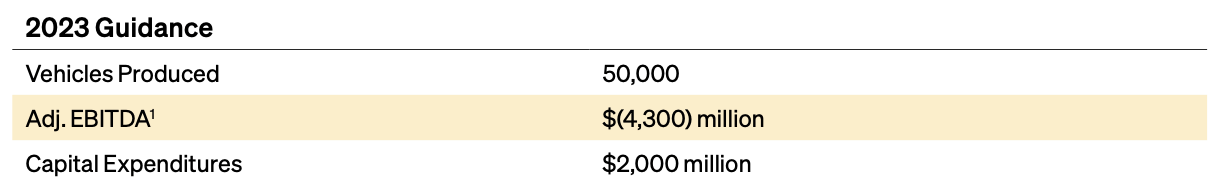

2023 was better with 57,232 vehicles produced.

But here’s where things change. In 2024, Rivian said it would produce 57,000 vehicles, only to make 49,476.

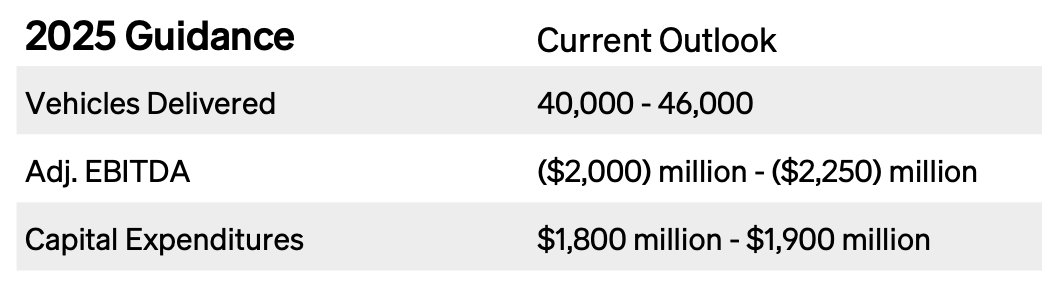

And 2025 production was expected to be down from there (ahem, demand problem).

Only to be lowered to just 40,000 to 46,000 vehicles recently.

Rivian has been public for nearly four years and is still producing less than 50,000 vehicles per year. That’s bad for a manufacturing company, no matter how you cut it.

Execution Problem: Redesigning R1

Some of the reduction in production will be blamed on plant upgrades to run more efficiently and an updated R1 design.

But here’s the question: Why does Rivian need to upgrade a brand-new vehicle and a brand-new production line?!?

That’s not normal!

It’s poor execution!

Execution Problem: Where’s EDV?

The EDV was supposed to be a floor of demand for Rivian, so what’s the status?

Amazon recently said they have 25,000 EDVs on the road. And they still expect 100,000 EDVs by the end of 2030.

But this isn’t a high-volume vehicle. It hasn’t taken over Amazon’s delivery network. Despite being released from an exclusive deal with Amazon, Rivian hasn’t made inroads with other customers.

There’s a theme here.

Either there’s weak demand.

Or there’s poor execution in delivering vehicles.

OR IT’S BOTH!

R2 to the Rescue?

And so the story goes that Rivian will update some of its equipment in Normal to accommodate the R2, a 2-row SUV that will sell for as little as $45,000.

The market is optimistic.

But can Rivian execute on R2 in a way it couldn’t on R1? And if it does, what’s the upside?

Is there demand for ~500,000 R2s, or about as many vehicles as Jeep sells overall in a year?

And if there is, can Rivian make enough money on each vehicle to make a profit?

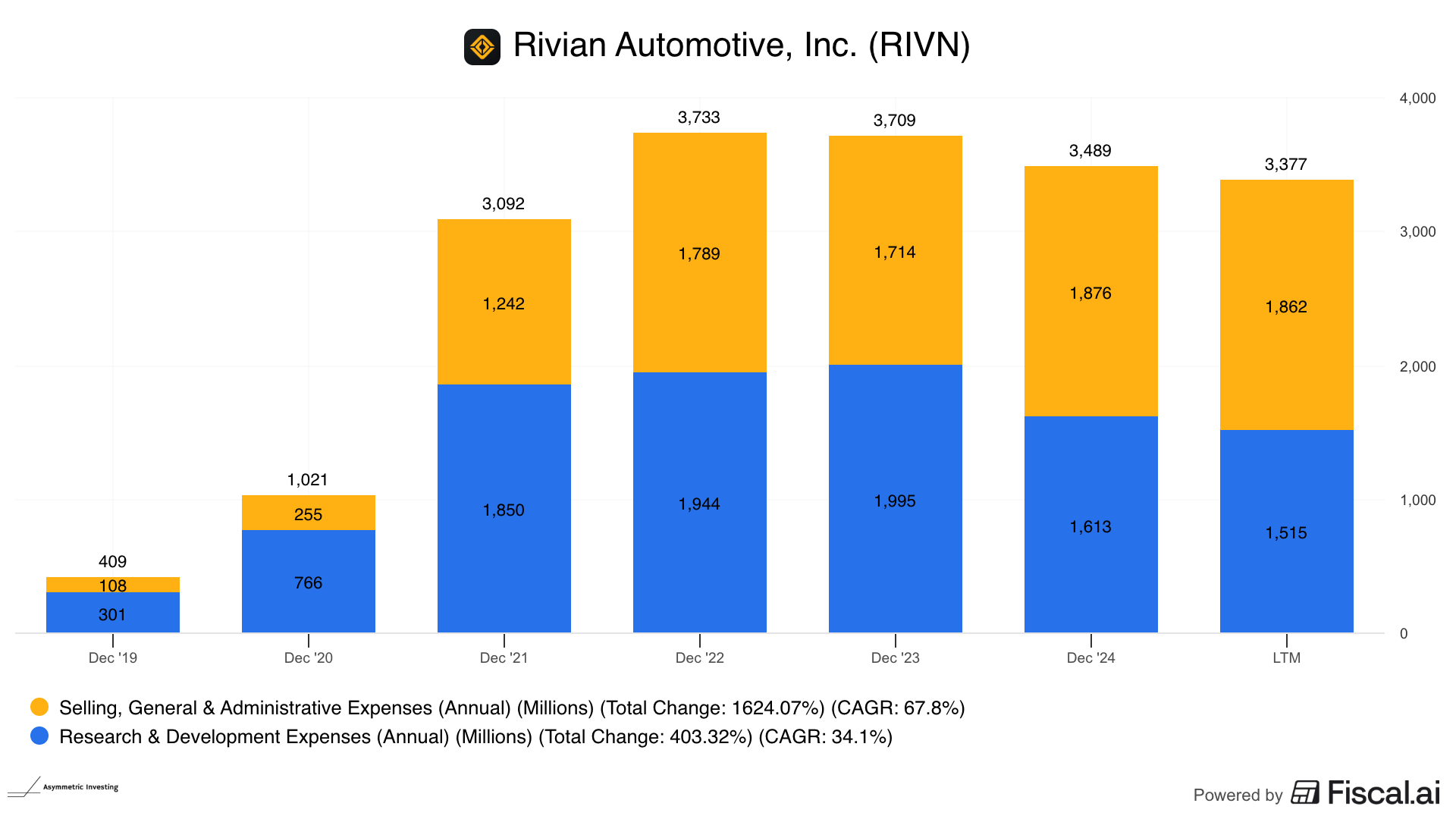

Rivian is currently spending $3.4 billion per year on operating expenses.

To get to profitability, Rivian needs to generate enough gross profit to cover its operating expenses (we’ll look past servicing debt for a moment). On a per-vehicle basis, that means making the following gross profit per vehicle at different capacity levels.

Capacity | Opex per Vehicle |

|---|---|

50,000 | $67,540 |

215,000 | $15,707 |

600,000 | $5,628 |

Remember, Rivian would have at best 215,000 units of capacity annually sometime in the next three years. Georgia is still in the earth-moving phase, and Rivian doesn’t have the money to build that plant. A $6.6 billion government loan should cover construction, but will this administration follow through on a loan given out by the previous administration?

And even if Rivian has all the demand in the world and funding to build the Georgia plant, will the company execute on the timeline it needs to and at the margins needed to make a profit?

History says, no!

AST SpaceMobile and the Delay Game

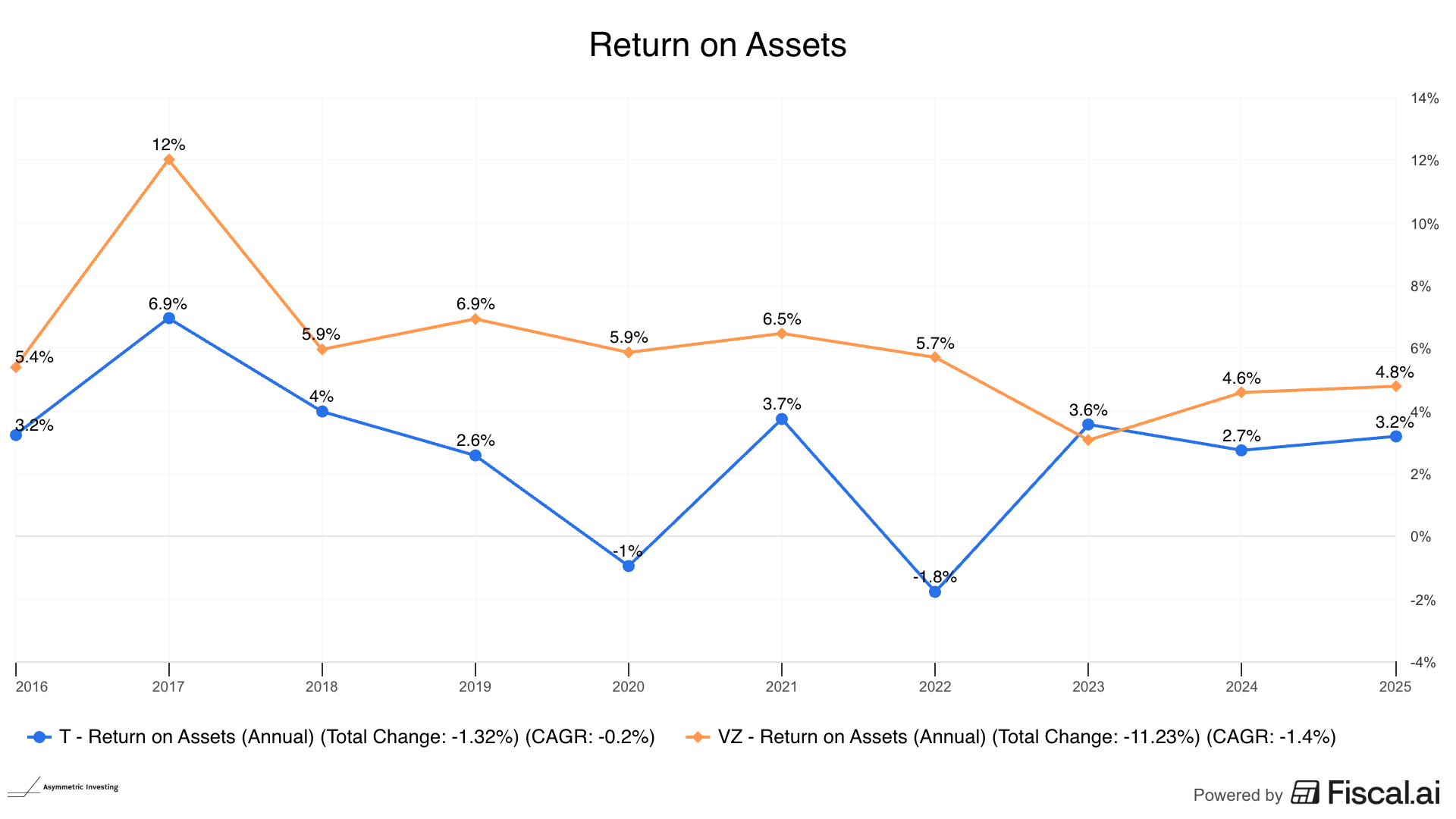

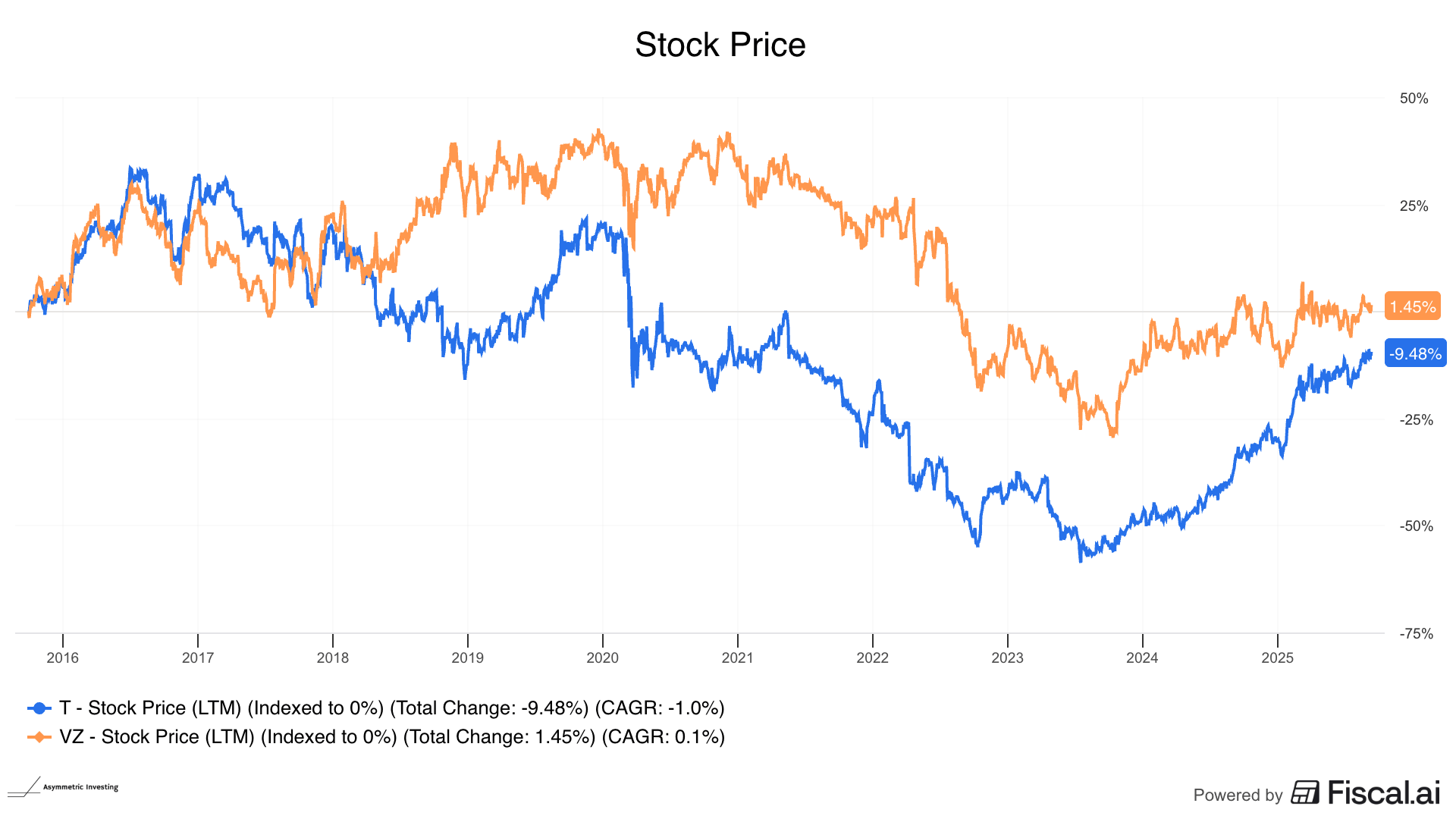

Telecom is another business many investors stay away from, and the reason is obvious. Look at Verizon and AT&T’s return on the billions in assets they invest each year.

And that’s translated to stocks that have gone nowhere for a decade.

But investors think AST SpaceMobile $ASTS ( ▲ 13.17% ) will be different. Satellites can serve the entire world, increasing the addressable market far larger than what traditional telecoms can reach.

Great story.

What’s the reality?

The first five satellites went into orbit about a year ago. Very little revenue has been generated since, and tests have only recently begun with carriers like AT&T. But the story was still intact.

On August 11, it was all systems go with 45 to 60 satellites expected by the end of next year.

We currently anticipate at least five orbital launches by end of Q1 2026, with orbital launches occurring every one to two months on average to reach our goal of 45 to 60 satellites launches during 2025 and 2026, which will drive continuous coverage in key markets such as United States, Europe, Japan, U.S. and other strategic markets like the U. S. Government.

Regarding our orbital launch campaign, FM1, our first next generation Block 2 BlueBird satellite will be ready to ship in August. We're working with our launch provider on determining the earliest possible launch date.

Less than two weeks later, we learned the launch of FM1 would be delayed until probably 2026.

Bluebird satellites, which will be the 45 to 60 satellites to build the first constellation, are being completed, and launches are expected soon.

But again, even small delays impact the payoff timeline and allow competitors space to move in.

This week, we learned SpaceX bought spectrum from EchoStar for $17 billion and will offer direct-to-cell service with the ability to do video calls within 2 years.

SpaceX has entered into a purchase agreement with EchoStar for 50 MHz of exclusive S-band spectrum in the US as well as global Mobile Satellite Service (MSS) spectrum licenses. This agreement will enable us to develop and deploy our next generation Starlink Direct to Cell constellation which will be capable of providing broadband service to cell phones globally.

n January 2024, SpaceX began deploying Starlink satellites with Direct to Cell capabilities to eliminate mobile dead zones. At the time, more than 20 percent of the land area across the United States and 90 percent of the Earth remained uncovered by terrestrial service.

Days after launching the first Direct to Cell satellites in 2024, the Starlink team was texting using unmodified cell phones on the ground. By spring, we were demonstrating video calling capabilities. A year and half later, and with more than 600 Starlink Direct to Cell satellites in orbit, the first-generation Direct to Cell constellation was successfully deployed and is operational across five continents. Today, Starlink Direct to Cell has become the largest 4G coverage provider on planet Earth, connecting over six million users and counting.

AST SpaceMobile will spend millions launching satellites over the next year, and then what?

Will people want to use the service?

Will they pay extra for a satellite connection from AT&T or Verizon, which have revenue share deals with AST SpaceMobile?

We don’t know what the economics look like, but AST SpaceMobile is already experiencing delays and has a competitor that’s out-executing it.

Is this another Plug Power-type negative ROI business with lots of hype and no profits?

More Than a Story

Look, I love a good story.

Many of the best-performing stocks in the Asymmetric Portfolio are built on a great story.

But every company I own also has to demonstrate its ability to execute.

They need to deliver new products on time and on budget.

That’s hard in the digital world, and it’s harder in the physical world. And when a company shows you they don’t execute effectively and experience delays, pay attention!

Without execution, asymmetric opportunities tend toward the 0X side of the scale, and I want to tip the scale to the 10X side if at all possible.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.