A squabble between Charter Communication and Disney boiled over last week when Charter went scorched earth on the entire cable industry.

we've reached the point of indifference under the current industry model

Is cable dead? Is Disney in trouble? What’s the future of ESPN? There are a lot of dynamics at play, but we might soon find out.

ESPN and Cable’s Safety Blanket

Cable was a great business for ESPN. Lots of people watched ESPN. EVERYONE paid for ESPN.

The power ESPN had within the cable bundle came down to how adamant customers were that they had access to ESPN. ESPN didn’t have to have all of the content, it needed enough content to be a “must have” for sports fans so that during a dispute fans put enough pressure on cable providers to force them to agree to Disney/ESPN’s increasingly burdensome terms.

This power dynamic broke the natural laws of supply and demand.

At its peak, there were 100 million cable subscribers, and all 100 million paid for ESPN. But it’s unlikely more than 20-30% of those subscribers actually valued ESPN at the $10 (I will stick with this affiliate fee figure throughout for consistency) everyone paid to get ESPN.

From a value perspective, 20 million people were thrilled about getting ESPN for less than the value they got from ESPN. But 80 million people only paid because they had no other option.

Streaming and MVPDs (multichannel video programming distributors, ex. YouTube TV) gave those 80 million people a way out of the cable bundle. So far, about 30 million people took the exit package.

As users dropped cable, ESPN’s business model has been undermined.

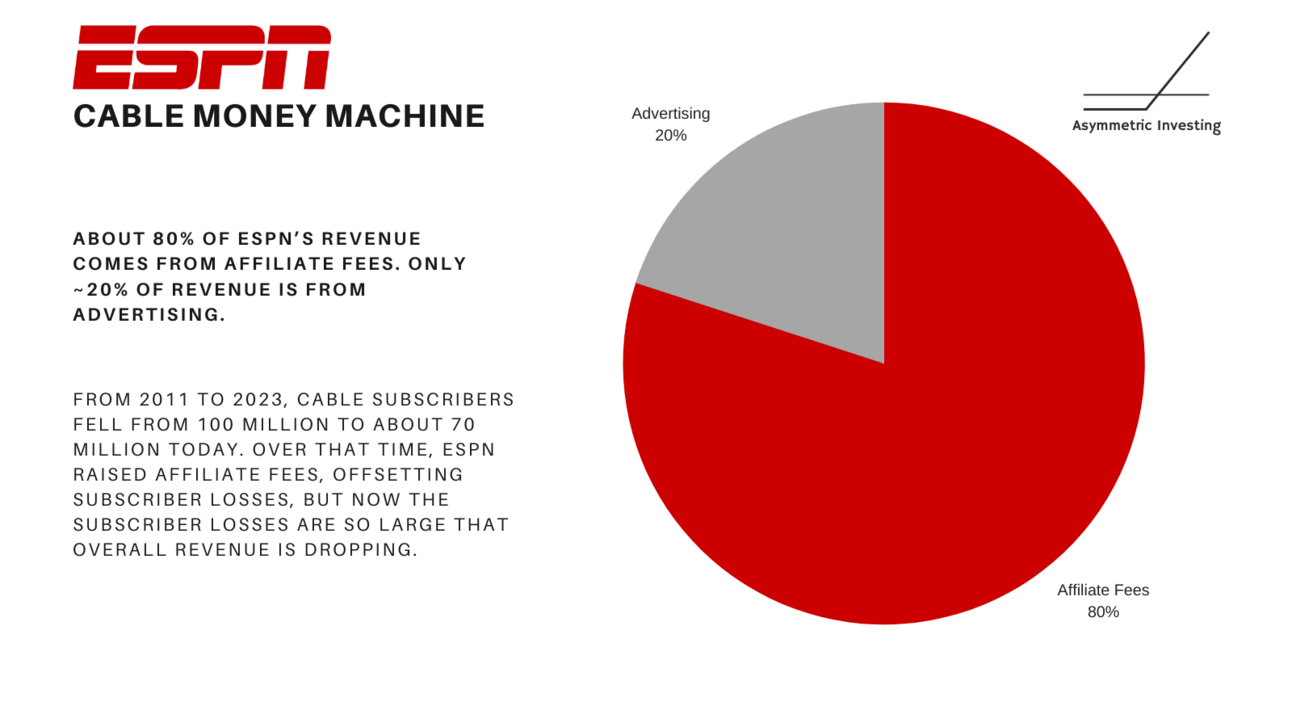

Affiliate fees account for about 80% of ESPN’s revenue, according to multiple estimates, so the loss of subscribers is depleting revenue. Price increases have helped blunt the losses, but could only offset losses for so long.

A MESSAGE FROM MASTERWORKS

Ultra-Wealthy Investors Fall in Love with This App (Here’s Why)

While financial markets tanked in 2022, one market saw its best performance in 277 years. The blue-chip art market – hauling in nearly $18 billion. Millionaires and billionaires love this market, but now you don’t need to be one to get access.

Masterworks is the fintech platform that lets you diversify your portfolio in this currently booming market. Their last three sales in 2022 handed investors 10.4%, 35.0%, and 13.9% net returns respectively.

After all, contemporary art prices outpaced the S&P 500 by 131% from 1995-2021 with a near 0 correlation to stocks according to Citi. Thanks to Masterworks, investing in art by Banksy, Picasso, and Basquiat is easier than using ChatGPT to automate your emails.

Want in? Offerings can sell out in just minutes, but Asymmetric Investing Subscribers can get early access by skipping the waitlist to join.

Streaming, Advertising, and Uncertainty

Moving to streaming would involve changing the business model for ESPN entirely. Instead of being supported by affiliate fees, the entire business would likely need to be supported by advertising.

The good news is, that advertising looks like a big opportunity in streaming.

Obviously, as has been noted by Kevin in his remarks, the advertising marketplace for streaming is picking up. It's more healthy than the advertising marketplace for linear television. We believe in the future of advertising on our streaming platforms, both Disney+ and Hulu. And we're obviously trying with our pricing strategy to migrate more subs to the advertiser-supported tier.

To put some numbers behind the move to streaming, the new pricing of Disney+ is $13.99 for ad-free and $7.99 for ad-supported, a $6 delta. Hulu will be $17.99 for ad-free and $7.99 for ad-supported, a $10 delta.

If Disney wants users to “migrate” users to ad-supported streaming it likely means ads are more than making up the $6-$10 delta in prices.

A mindset shift

It’s possible that ESPN’s economics could work for streaming. However, moving from an affiliate fee-driven business model to an advertising-driven business model would require a mindset shift for Disney and ESPN.

Cable is a scarce resource with limited channels, limited hours in the day, and limited customers in a carrier’s service area. The internet brings abundance.

The streaming customer base isn’t limited to how many cables go to homes, it’s limited to how many people have the internet. And worldwide, that number is reportedly 5.3 billion people.

On the upside, the addressable market is bigger for streaming and advertising revenue per user will likely be much higher than it was on cable.

On the downside, customers can’t be forced to pay for a service like ESPN like they were under the cable model. ESPN needs to drive usage to a larger base of users and create higher value/price tiers for power users.

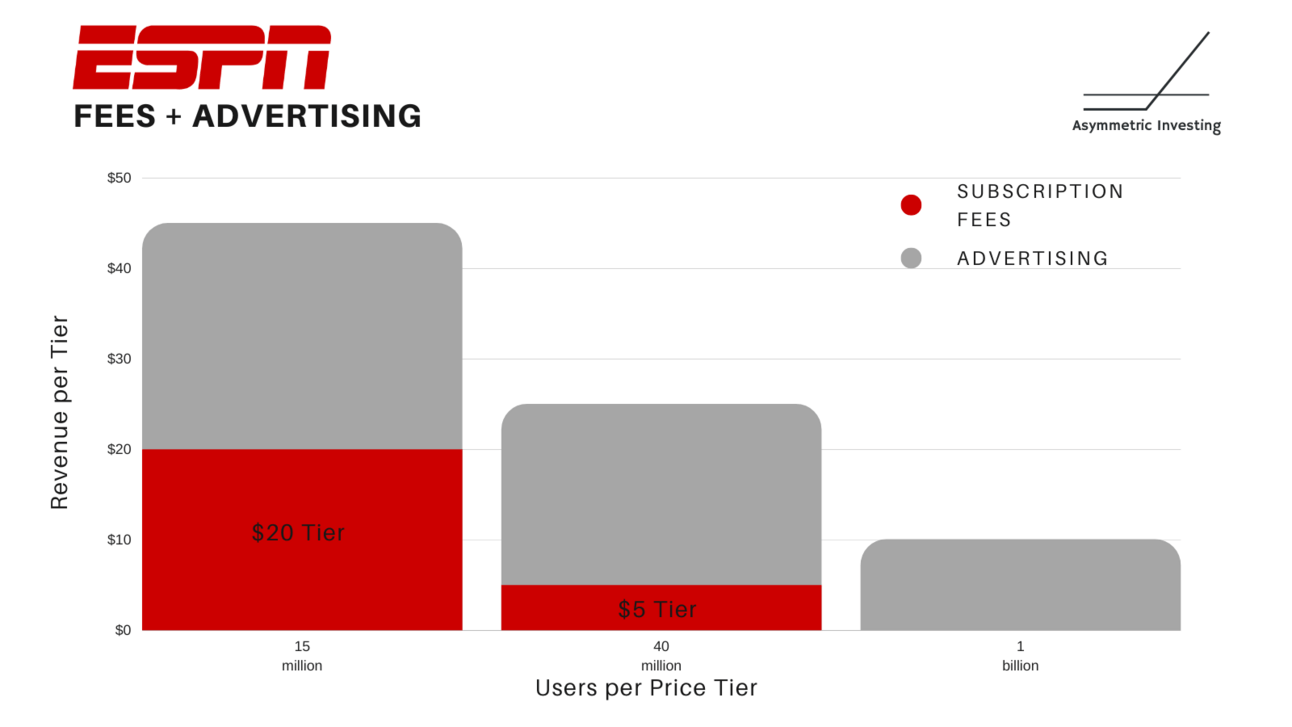

If ESPN can pull off the shift, price tiers and revenue might look something like this:

Under this scenario, ESPN would be trading fixed monthly fees for advertising revenue on a larger base. But the pie is significantly bigger.

Instead of ~$8 billion in affiliate fees and ~$2 billion in advertising revenue under the cable model, I have shown ESPN having 15 million subscribers paying $20 per month for a super-premium tier and 40 million subscribers paying $5 per month for a premium tier, equaling $6 billion in subscription fees. Some of those fees may need to be shared with distributors, which I’ll get to below.

The opportunity is in advertising where I’ve shown $25 in ad revenue from power users, $20 for the mid-tier, and $10 for free users for $21.1 billion in total revenue.

In total, my estimated revenue of $27.1 billion is nearly triple the $10 billion for ESPN today.

These are estimates, but they’re not unreasonable. The delta between ad-free and ad-supported packages is around $6-10 per month and sports content would likely generate even higher premium ad rates.

While domestic linear advertising revenue declined year-over-year, ESPN ad revenue increased by 4%, demonstrating the relative strength of sports.

We also know YouTube generated $29.2 billion in revenue in 2022, so there’s precedent for the scale of these numbers.

Iger’s Biggest Challenge

The biggest question is: How do we get from here to there?

Theoretically, streaming would give ESPN more distribution options. Cable distribution is often limited to one or two distributors in a given geographic area. With streaming, ESPN and Disney could distribute through cable broadband providers, MVPD companies, Apple TV, Amazon Prime, Verizon/AT&T/T-Mobile, and more.

Some of those partners would likely demand a 20%-30% cut of the subscription fee. Others would be more than happy to subsidize subscribers to get them on a service that’s more lucrative elsewhere (ex. bundle streaming + high margin 5g broadband).

Distribution is the key to getting from today’s cable model to a potentially more lucrative streaming model. But it’s not a straight line and the future is uncertain.

Am I right that more people would watch ESPN if there were a free streaming option? Am I right that there’s potentially more money in a model driven by streaming ads?

If Charter is indeed “indifferent” ESPN may not have a choice but to find out if streaming can work for sports.

ESPN messed around. It’s about to find out.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.

“Net Return" refers to the annualized internal rate of return net of all fees and costs, calculated from the offering closing date to the date the sale is consummated. IRR may not be indicative of Masterworks paintings not yet sold and past performance is not indicative of future results. See important Regulation A disclosures at masterworks.com/cd.