I am happy to announce there is FINALLY one place to find every stock in the Asymmetric Portfolio, how much I have allocated to each stock, and the executed trades and prices. Premium subscribers get full access at the link below.

This article builds on the Crocs Spotlight, which you can read here.

Investing in asymmetric opportunities isn’t just buying growth stock at all costs. It’s about finding investments where the upside potential far outweighs the capital being put at risk. Growth matters, but so does price.

In a very simple sense, I’m looking for stocks where the three main drivers of stock performance are in my favor.

Revenue growth

Margin expansion

Multiple expansion

All three matter, but it’s rare to find all three in one stock. With Crocs, I think we have a company that’s growing more quickly than the market thinks and has a tremendous opportunity for multiple expansion.

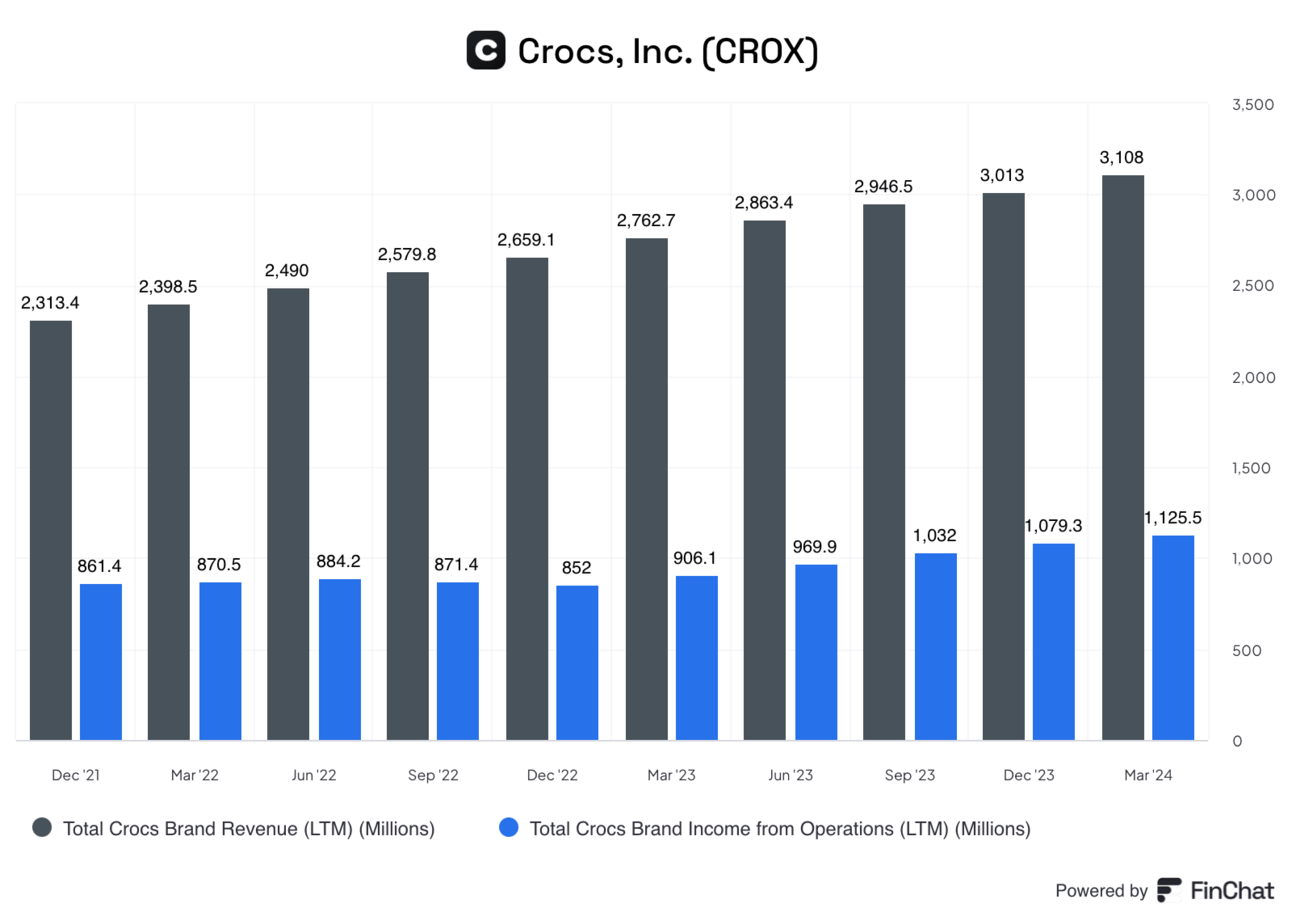

Crocs Is A Growth Brand

This may sound crazy, but the Crocs brand is a growth brand. In fact, Crocs footwear revenue is outgrowing Nike and Under Armour by a wide margin.

The consistency and stickiness of Crocs always amazes me but the company has proven the ability to grow the brand consistently and do so at a very high margin. It doesn’t hurt that rubber shoes are relatively cheap to produce, so price points are accessible to almost any budget.

In the first quarter of 2024, the Crocs brand grew an impressive 14.6% — boosted by a 24% increase in international sales — and management said they now expect 7% to 9% growth in 2024 (up from previous guidance of 4% to 6% growth). And if Crocs is growing like this, maybe it shouldn’t trade like a value stock, which I’ll get to below.

As great as the Crocs brand is, the real asymmetric upside is in turning HEYDUDE from a revenue growth headwind into a tailwind. Crocs won’t earn a better multiple from the market until that happens.

The hope is that changes to how HEYDUDE is distributed through more curated wholesale channels will turn the brand around. But 2024 guidance went from “flat to slightly up“ to expected to contract “contract (10%) to (8%)“ in just the past three months, so we’re still moving in the wrong direction.

Don’t sleep on Crocs’ growth and if HEYDUDE turns around this could be a phenomenal performing stock.

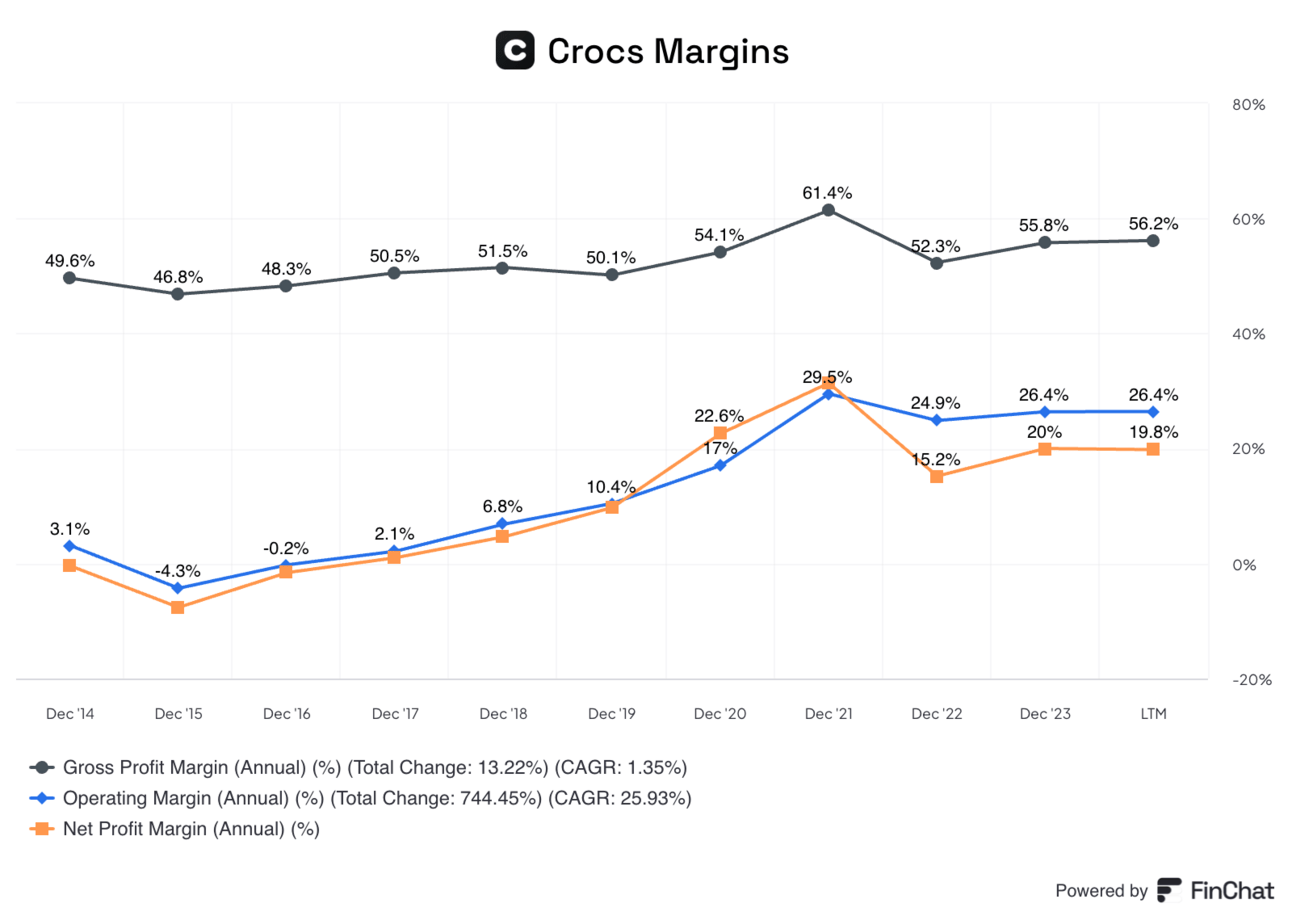

Margins May Be Tapped Out

I mentioned margin expansion as a possible catalyst for stocks, but in the case of Crocs, there’s probably not a lot left to squeeze out of the business. You can see below that net margins are near 20%, which would be the envy of almost any company.

Maintenance is all we can expect from margins at the moment.

Multiple Expansion Is (Almost) Pure Upside at Crocs

Price matters when buying stocks and in October 2023 when the spotlight was published Crocs was trading for 7.9x earnings. At that price, the market thinks revenue will drop and margins will fall, but we’ve seen the opposite.

The multiple has expanded at Crocs but would need to double or more before matching comparable companies in the industry.

In the meantime, management is returning cash to shareholders through stock buybacks and buying back debt taken out for the HEYDUDE acquisition.

Multiples could expand, but even if they don’t the company can buy back stock at an attractive price, adding leverage to potential margin expansion in the future.

Asymmetric Investing sometimes looks like value investing on the surface. But what I see in Crocs is the potential for higher growth than the market expects and nowhere to go buy up for valuation multiples. First quarter 2024 results showed the company is heading in the right direction and expects 2024 to be a great year.

The upside potential far outweighs the downside risk and that’s why this is already one of the best-performing stocks in the Asymmetric Portfolio.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium manages an account that holds shares of Virgin Galactic. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.