I hope you had a wonderful week!

Vacation is over and Asymmetric Investing will be back to a more normal schedule this week, highlighted by the portfolio buys on Friday. With that, on to the week that was.

In case you missed it

Here’s some of the content I put out this week. Enjoy!

Coinbase Launches Base: Coinbase’s Base blockchain seems to be getting a lot more adoption than the NFT platform the company launched. That’s good news and may play a big role in Coinbase’s future.

Virgin Galactic’s (Potential) Road to Recovery: Virgin Galactic needs money. We’ve known that for a long time, but a falling stock price makes raising funds harder. I covered a likely fundraising scenario here.

Rivian’s Tight Rope: Rivian has a ton of cash, but it’s also burning cash like crazy and needs to build a new plant for the R2 line. The tight rope may be more precarious than you think.

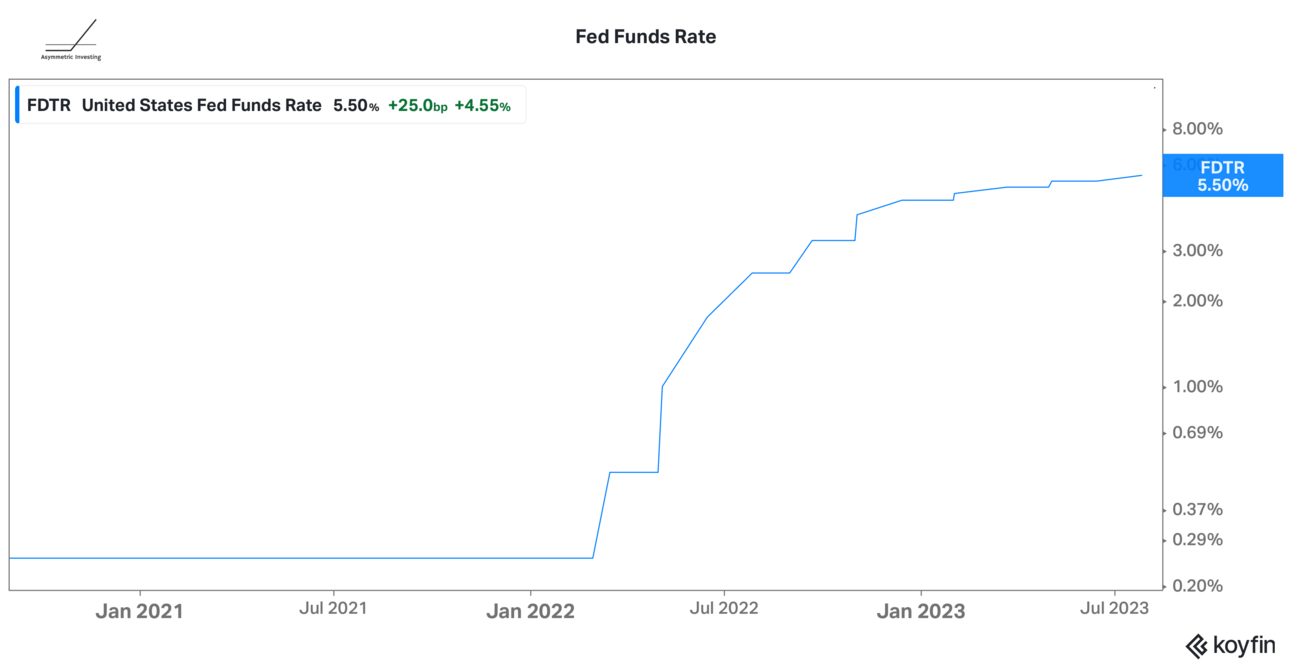

The Fed Talks Tough

A common statement in video comments goes something like this: “Yeah, but when interest rates come down 🚀.”

Don’t count on it.

Federal Reserve Chair Jerome Powell said this week that rates will likely remain higher for longer than people expect.

Why? Because inflation is stubborn and he doesn’t want to be the Fed Chair who lowers rates and allows inflation to come back.

There’s also no reason to lower rates when the economy is doing relatively well. Maybe that means Powell pushes the U.S. economy into a recession, but that’s a risk he’s willing to take. And will lower rates be bullish in a recession?

I’m not a regular Fed watcher, but we need to understand broadly what the Fed is thinking because interest rates do impact investing. My takeaway is that “interest rates will come down soon” isn’t a good investment thesis right now and we should want high rates to be a tailwind.

Thank you for being an Asymmetric Investing subscriber. If you want all of my stock deep dives, stock updates, and access to Asymmetric Portfolio trades before I make them you can subscribe below. The premium subscription is what makes this newsletter possible so I appreciate the support.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please, do your own research before acquiring stocks.