I thought Airbnb $ABNB ( ▲ 5.06% ) was one of the most interesting stories on the market last week, and most observers went down the wrong path in analyzing the company.

I’ll critique what we saw last week, but it’s what’s built over the next 5 years that matters for Airbnb.

More on that in a moment.

The market seems to be realizing that tariffs are here to stay, and that’s going to be a negative for the economy.

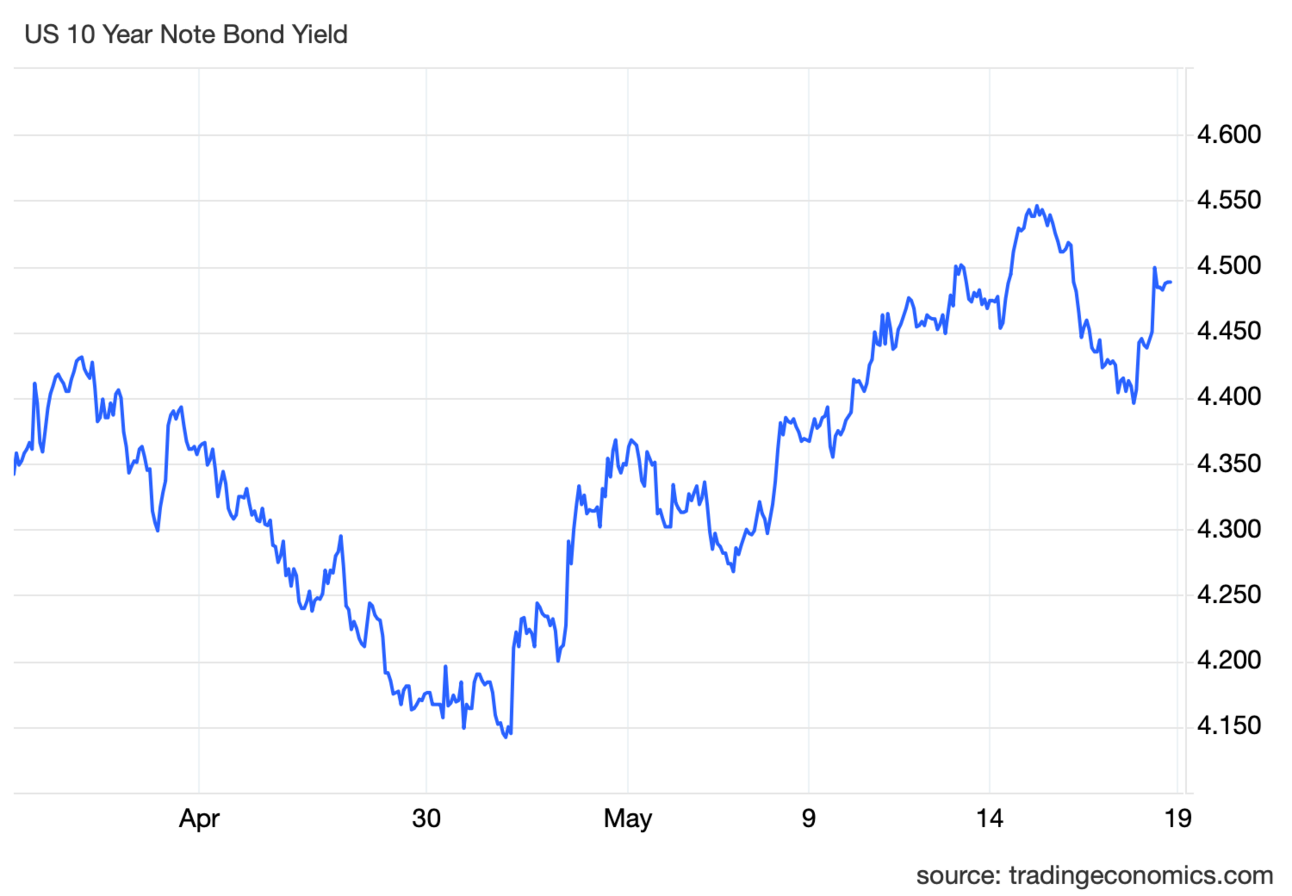

Stocks are tempering recent gains and falling in futures trading as I’m writing. And bond yields are up, which tells you investors are fleeing to perceived safety.

Here’s a look at the 10-year treasury rate, which is up despite weakening in the economy, which falling rates would usually follow. But rates aren’t down because the market thinks the Fed will need to raise interest rates to combat inflation.

And all of this is happening with a negative GDP reading in Q1, which would also usually lead to lower interest rates.

I’m not pointing this out to provide a prediction, but rather to say we’re in a more uncertain period than many people think after the market’s bounce in the past month. Maybe the tariff uncertainty drives a booming economy. Maybe it leads to a recession.

But with Walmart saying they’re going to have to raise prices, we know prices are going up, and the 2nd and 3rd order effects are what will determine the market’s direction over the next year. Those impacts are still unknown.

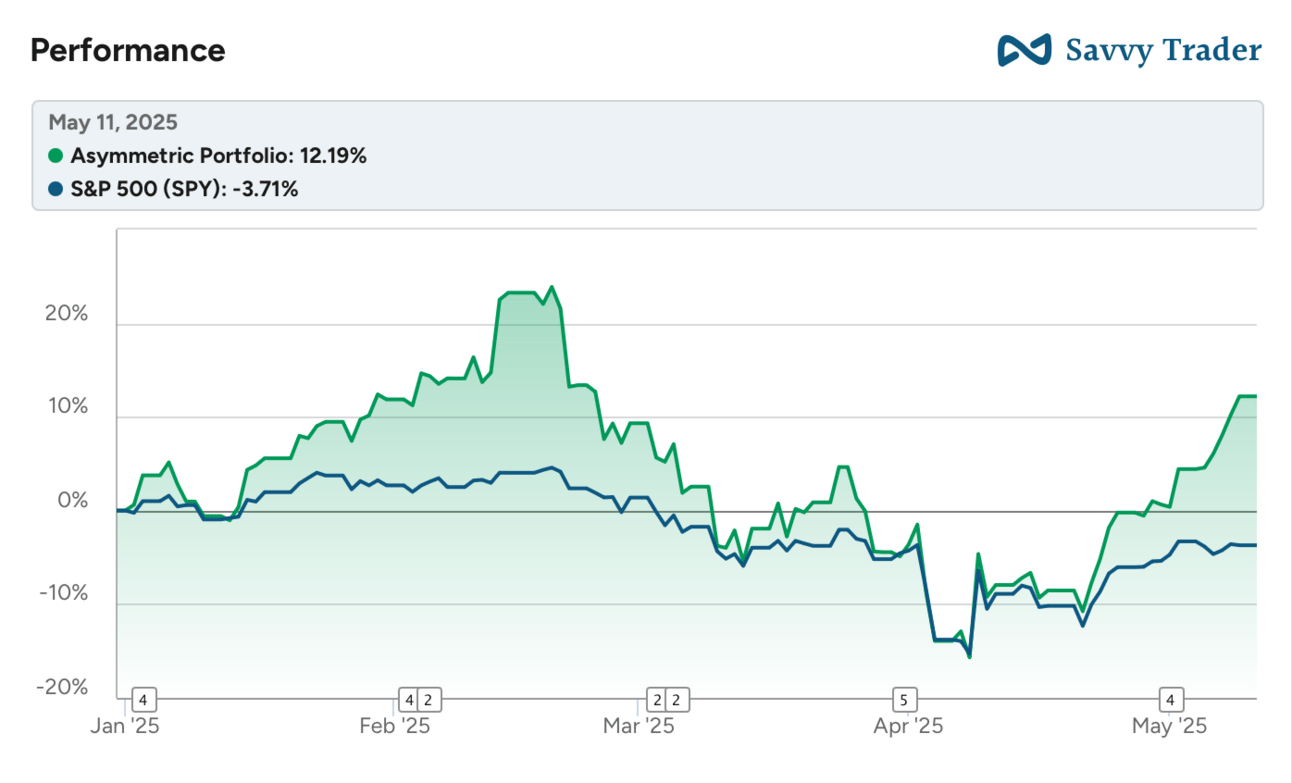

As for the Asymmetric Portfolio, it’s been an incredible run this earnings season. Almost every company in the portfolio is performing well, and some are up huge since hitting April lows.

All of the charts you see here are easy to make, research like finding transcripts and insider buys is easier than ever, and you can even ask an AI about earnings transcripts. I can’t say enough how much easier it’s made my research, and you can start with 2 weeks free. 👇

In Case You Missed It

Here’s some of the content I put out this week.

Disney’s Streaming Sports Play: ESPN is going streaming, and it could change the industry’s dynamic for years to come, with Disney being the big winner.

On Running’s Tariff Talk: On Running isn’t scared of tariffs, and they’re already talking about raising prices.

What’s Next For Coinbase?: Coinbase made a big acquisition, and it could fuel more international growth.

Airbnb’s Incomplete Story

Airbnb had a week.

The company announced its biggest update in years with an updated experiences tab and the addition of services to Airbnb. Now, when you open up the app, it looks like this:

The response was pretty subdued and for good reason.

Experiences have been a flop in the past and most of the pre-approved services were pretty ho-hum. Hair stylists, massages, and personal chefs may be nice if you’re staying at an Airbnb to bring some of the hotel amenities to you, but I don’t think they make Airbnb an app I’m going to open on a weekly basis.

And that was Chesky’s vision. He wants Airbnb to be an app people go to a few times a month, not a few times per year.

Ben Thompson of Stratechery wrote a scathing review of the new offerings and they’re a sound critique.

While Chesky romanticizes Airbnb’s founding story and the idea of making friends with strangers anywhere in the world, the reality of Airbnb is often much different: professionalized hosts you never see giving you codes to non-descript condos or houses with endless rules and fees, all governed by fake courtesy and the fear of a bad review.

…

More broadly, setting up Airbnb as a counter to everything that has allegedly gone wrong with tech is an interesting choice, when Airbnb is arguably more emblematic of tech’s recent impact than any other company: on one hand, Airbnb has created new markets that didn’t exist previously, transforming real estate from static assets to much more dynamic ones, and providing a dizzying array of new choices to travelers; on the other hand, the cost of the former has been the transformation of residential neighborhoods to awkward hotel districts, and the latter has entailed creating a massive market and making everything into a transaction.

Those marketplace dynamics govern everything: Airbnb hosts have a fixed asset that needs to maximize utilization to earn money; that means they are beholden to a service that brings huge amounts of demand consistently, minimizing the number of vacant nights. Travelers, for their part, want something other than a hotel for whatever reason (families with kids, for example), but still want a mechanism to establish trust; Airbnb succeeds by bringing these parties together at scale. Or, to put it another way, the route to connecting real people with real assets necessarily first entails atomizing both sides of the market such that only Airbnb can bring them together. Sure, real people in real houses is different than looking at a screen, but it’s arguably less enduring and meaningful precisely because of just how impersonal and fleeting the transaction is.

The more important point about the marketplace dynamics of Airbnb is that it’s not clear why they would extend to the new offerings Chesky announced.

Consider Experiences, which Airbnb already tried to get off the ground 8 years ago. In the presentation Chesky derides traditional tourist traps like sight-seeing buses or famous landmarks, and promises that bespoke tours or classes from locals will be much more meaningful. The problem is that bespoke means marginal costs, which are only manageable with very high prices. Very high prices, however, mean much lower demand. Thus, what you actually end up getting are cookie-cutter experiences that can be delivered with relatively low marginal costs, which are exactly the experiences Chesky derides!

It’s true that Airbnb is a marketplace and a variable cost product (services and experiences) have different incentives than a fixed cost product (housing).

But I think that misses the role Airbnb plays as a discovery mechanism.

Can Airbnb Create a New Marketplace?

The critiques of Airbnb’s model may be correct. And if that’s the case, investor still own a great business.

But Asymmetric Investing is about the upside of what doesn’t yet exist — and isn’t priced into the stock. And that’s what I see as possible with Airbnb.

The experiences and service offerings as currently presented aren’t all that compelling. But they could lay a foundation for a much more compelling product.

Take Airbnb itself as a path.

The company was built to be a marketplace for extra space in an apartment and became a place innovators could create new lodging concepts and rent them out to make a profit. Does this home exist without Airbnb?

So, the question is, what can benefit from a new discovery tool and who are the innovators that could build on the new Airbnb experiences and services?

Existing Inventory

The lowest hanging fruit is existing inventory that’s looking for buyers.

For example, I’ve spent a fair amount of time attending kids birthday parties over the past month and that’s the kind of experience I could see being perfect for a centralized marketplace like Airbnb.

Today, if you want to plan a kids birthday party you can:

Google

Go to a local birthday website

Grab a local entertainment brochure

Copy one of the last parties you went to

What’s consistent is the bifurcation and high expense of these discovery mechanisms. Nothing about the process of discovery is easy.

As someone who once ran a hot birthday party spot, I know these sites also want an arm and a leg for ad space that may or may not pay off. So, there’s a problem to be solved on the supply side and critically, these are infrequent purchases, not long-term relationships.

Airbnb is offering a discovery mechanism where the cost is only paid with a successfully booked event. In other words, it’s a variable cost.

This could be both a larger audience for birthday party providers, and more aligned economics.

I’m using kids birthday parties as a stand-in, but this could be any kind of service or event that you may do infrequently. Maybe it’s an ice bar for a winter party, a magic show, whiskey tasting event, a boat rental, or horseback riding lessons.

I’m throwing out ideas, but the point is, there are lots of businesses looking to reach customers if there was a centralized marketplace with the right incentives. Airbnb could be that marketplace.

The Unknown Upside of Innovation

And then there’s the real upside, which would be services and experience that would only be possible on Airbnb.

People came up with all kinds of cool Airbnb lodging concepts once Airbnb existed.

Will there be a similar void to be filled in services and experiences?

And more importantly, when with Airbnb open up services to more offerings beyond the cookie-cutter services available today?

I think the compelling opportunity for Airbnb is in products we can’t even imagine today. And maybe that’s what keeps you opening up the Airbnb app a few more times per year?

“Hey, Airbnb, my wife’s birthday is coming up. What interesting experiences can we do within 10 miles of home?”

That’s a discovery tool that’s worth Airbnb’s take rate.

Disclaimer: Asymmetric Investing provides analysis and research but DOES NOT provide individual financial advice. Travis Hoium may have a position in some of the stocks mentioned. All content is for informational purposes only. Asymmetric Investing is not a registered investment, legal, or tax advisor, or a broker/dealer. Trading any asset involves risk and could result in significant capital losses. Please do your research before acquiring stocks.